January, 7, 2021

By Forbes and Walker Tea Brokers

Overview

2020 will no doubt go down in history as one of the most challenging years with the Covid-19 pandemic changing the world in many ways. The Sri Lankan tea industry was no exception as its world-famous outcry system of auctioning tea having a 137-year-old history was changed to a digital system virtually overnight.

Once again, the tea industry showed its resilience by rising to the occasion in digitalising the auction in a very short period of time, which facilitated the uninterrupted sale of tea.

This initiative was spearheaded by the Colombo Tea Traders’ Association (CTTA) and supported by the Colombo Brokers’ Association (CBA) and its technical partner CICRA Holdings.

Concurrently, many other auction centers around the world too adopted and changed to the methodology of selling tea digitally, transforming the character of the ‘Tea Men.’ The Corona virus outbreak left the global economy looking bleak, with likely recessions in many developed economies across the world.

Whilst there was some hope of recovery in the 2nd half of the year, the continuation of the pandemic shattered all hopes, which meant the uncertainty continued. Consequently, lower fiscal revenues and higher public expenditure placed many countries in a slump.

Notwithstanding the gloom and doom – tea, with its wellness properties and considered to be a cheap beverage, gathered widespread interest globally which helped the wheels of the tea industry to keep turning.

Consequent to the lower volumes that were harvested from around the latter part of 2019, prices were edging up on the previous year’s levels, which was propelled quite sharply following the pandemic, where consumers around the world went on a panic buying spree of food items, of which, tea was no exception. Consequently, many importers remained desperate for urgent shipments, which led to strong buying at the Colombo Tea Auctions.

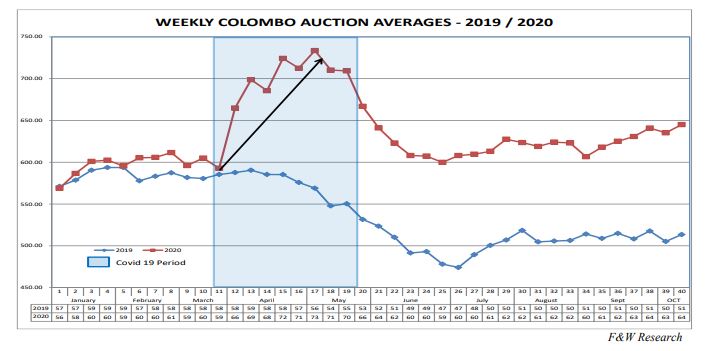

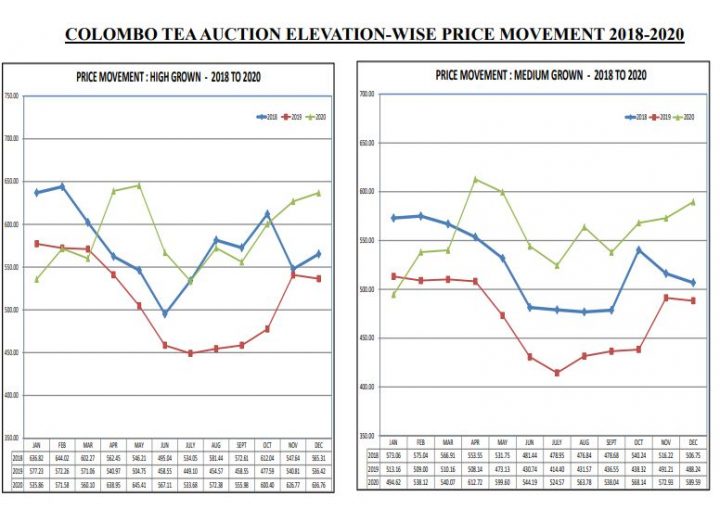

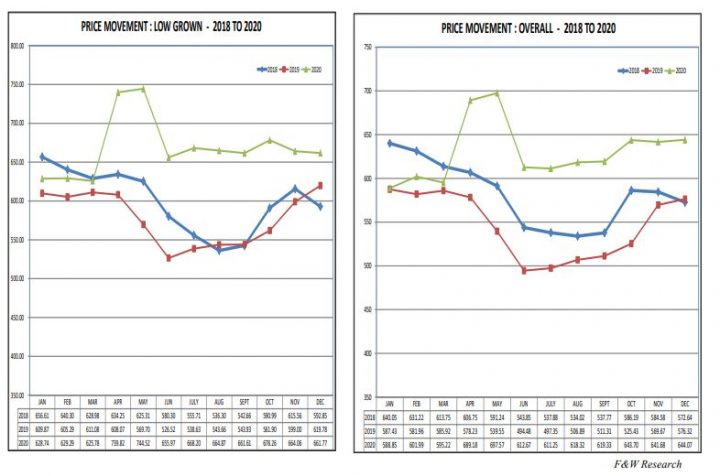

Post Covid-19 impact is amply demonstrated in the following graph.

Global tea production fell in 2020 after a continuous increase for many years as weather conditions have been mixed and in many major tea producing countries. Kenya would be the only exception where production has increased quite significantly and largely reflects a cyclical recovery after a drought induced decline in 2019.

Indian production was badly impacted by the Corona virus pandemic with restrictions on tea plucking during the shutdown of economic activity in March-April and thereafter the heavy rain, resulting in flooding in most parts of Northern India contributed to an estimated 15% fall in production in 2020. This could be quite significant particularly considering that almost 80% of India’s production is absorbed by its domestic demand.

Quarterly Update – 2020

FIRST QUARTER 2020

Production

Sri Lankan tea production declined to a 53.1 M/Kgs from a 73.4 M/Kgs during the corresponding period in 2019 (a decline of 27%).

Auction Averages/Prices

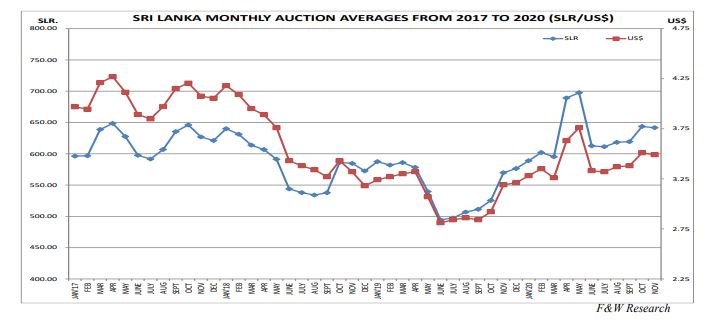

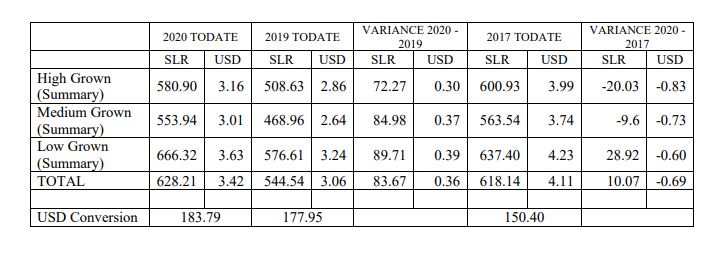

Total auction average of Rs. 594.81 showed an increase of Rs. 9.51 compared to Rs. 585.30 recorded during the 1st quarter in 2019. Mid Growns appreciated Rs. 9.86 quarter on quarter, whilst Low Growns showed a gain of Rs. 19.51. However, High Growns recorded a decline of Rs. 19.61.

Exports

Tea Exports totalled 59.5 M/Kgs, recording a decline of 14.1 M/Kgs vis-à-vis 73.6 M/Kgs during the corresponding quarter in 2019. Earnings from tea exports of Rs. 49.2 billion records a deficit of Rs. 13.2 billion vis-à-vis Rs. 62.4 billion during January-March 2019. Overall FOB values too declined to Rs. 826.39 in 2020 from Rs. 847.57 in 2019.

SECOND QUARTER 2020

Production

Total tea production of 75.3 M/Kgs recorded a deficit of 10.1 M/Kgs vis-à-vis 85.4 M/Kgs during April-June 2019. During this period, Low Growns showed the steepest negative variance of 7.2 M/Kgs followed by negative variances of 1.5 M/Kgs and 0.6 M/Kgs from the High and Medium Grown regions respectively.

Auction Averages/Prices

All elevations recorded a sharp increase in the auction prices following the panic buying spree post Covid-19. In the second quarter of 2019/2020, Low Growns gained Rs. 136.38 followed by High Growns Rs. 109.93, Medium Growns Rs. 108.99 and the total Colombo auction average by Rs. 120.93. Furthermore, a significant appreciation on prices quarter on quarter – High Growns Rs. 54.43, Medium Growns Rs. 57.89, Low Growns Rs. 76.38 and the overall average by Rs. 62.98.

Exports

Tea exports totalled 64.5 M/Kgs, recording a deficit of 7.0 M/Kgs vis-à-vis 71.5 M/Kgs during the corresponding quarter in 2019. Export earnings totalled Rs. 56.8 billion, recording a decline in earnings of Rs. 2.6 billion compared to Rs. 59.4 billion in 2019. FOB value of Rs. 831.11 recorded an increase of Rs. 50.17 vis-à-vis Rs. 881.28 in corresponding quarter in 2019.

THIRD QUARTER 2020

Production

Total production showed some recovery and totalled 72.0 M/Kgs during the quarter under review, with a marginal deficit of 2.0 M/Kgs when compared to the 74.0 M/Kgs harvested during the corresponding quarter in 2019. End 3 rd quarter deficit 31.0 M/Kgs (13%).

Auction Averages/Prices

Consequent to greater stability and availability, both in Sri Lanka and globally, auction prices began to take a correction commencing around end May and well into the 3rd quarter. Therefore, whilst auction prices continued to reflect a significant increase over its corresponding prices in 2019, 3rd quarter auction averages showed a fairly significant decline on the 2nd quarter auction averages.

Exports

Tea exports totalled 74.2 M/Kgs marginally behind 75.9 M/Kgs in 2019. Export earnings Rs. 64.4 billion vis-à-vis Rs. 60.6 billion in 2019. End 3rd quarter 2020, tea exports totalled 198.2 M/Kgs vis-à-vis 221.0 M/Kgs in 2019, a deficit of 22.8 M/Kgs. Export earnings totalled Rs. 170.5 billion vis-à-vis Rs. 182.5 billion, which records a deficit of Rs. 12.0 billion in earnings.

FOURTH QUARTER 2020 -INTERIM

(At the time of compiling this report, industry data pertaining to the period under review remains incomplete.)

Production

October/November production totalled 48.2 M/Kgs, recording an increase of approximately 3 M/Kgs. Whilst this would be the only quarter to show a positive variance in production and if December production would equal the 21.8 M/Kgs achieved in 2019, annual production for the year 2020 would be marginally above a 270 M/Kgs. This would record approximately 30 M/Kgs (10%) shortfall when compared to 2019.

Auction Averages/Prices

Tea prices in the 4th quarter shows an improvement on the 3rd quarter. Total auction average of Rs. 643.15 records an increase of Rs. 27.35 from Rs. 615.80 in the previous quarter. High Growns Rs. 622.09 vs. Rs. 528.70 in 2019, a quarter-on-quarter gain of Rs. 93.39. Mid Growns Rs. 577.10 vs. Rs. 535.16 in 2019, a quarter-on-quarter gain of Rs. 41.94. Low Growns Rs. 677.84 vs. Rs. 644.07 in 2019, a quarter-on-quarter gain of Rs. 13.77.

Total auction average of Rs. 643.15 showed an increase of Rs. 89.44 compared to Rs. 553.71 recorded during the 4 th quarter in 2019. All elevations have shown significant appreciation in prices. High Growns Rs. 107.22, Mid Growns Rs. 107.12 and Low Growns Rs. 78.65.

Exports

Here again, the available data would be for the period October/November which totals 43.3 M/Kgs vis-à-vis 47.8 M/Kgs during the corresponding period in 2019. This records a deficit of 4.5 M/Kgs increasing the to date deficit up to end November to 27.3 M/Kgs. Export earnings totalled Rs. 38.4 billion vis-à-vis Rs. 38.9 billion, marginally behind the 2019 earnings and bringing the to date deficit in earnings up to end November to Rs. 12.5 billion.

2020 Projected Tea Industry Performance in Summary

SRI LANKA MACROECONOMIC UPDATE – 2020

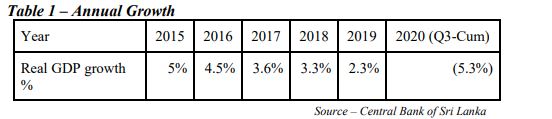

The year 2020 will perhaps be known globally as the year of the Corona virus. Many developed countries are impacted significantly by the Covid-19 pandemic and the latest projection by the World Bank is that the global economy will contract by 5.2% in 2020. Sri Lanka was no exception and consequent to the economically crippling lockdown for over 2 months, wiping out economic activity from late March was predicted by the Asian Development Bank to post a negative growth of 5.5% for 2020. The World Bank was more positive, projecting a contraction of 3.2% for the year. At the time of compiling this report, the economy had contracted by 5.3% by the end of the 3rd quarter. The country debt default risk was also seen as high by all major rating agencies with Fitch, S&P and Moody’s downgrading the country’s bonds. However, the resilience of the country cannot and should not be underestimated. This is clearly seen with the quarter-on-quarter growth figures reported below.

(We report below the key indicators of the economy updated as at the time of reporting)

Economic Growth The overall annual growth levels of the country have been slipping over the past five years and now recording a negative growth by the third quarter of 2020. However, the Covid-19 affected second quarter appears to be the main cause for the decline this year.

The analysis of the quarterly results show the problems of the country were deep rooted and the negative growth in the largely Covid-19 unaffected first quarter is a reflection of the issue. Both agriculture and industry sectors were showing large negative growth figures in the first quarter.

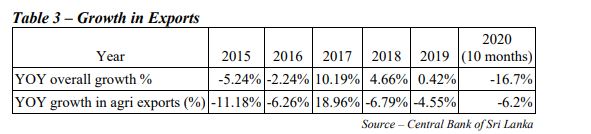

Exports: The export sector of the country has grown only 8% over the past 5 years, with an annual average growth rate of only 1.6%. The agriculture sector has performed the worst, showing negative growth in all but one year in the past 5 years.

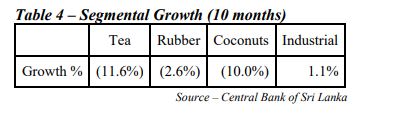

Production: The first 10 months saw a decline in agricultural production although the industrial sector saw marginal growth.

Inflation: Inflation as measured by the movement in the National Consumer Price Index (NCPI) was 5.5% in October 2020 (5.6% in October 2019) with the annual average as at the end October 2020 being 6.2% (2.8% in 2019). It is observed that inflation in 2019 which began at 1.6% in January 2019 ended the year at over 6%, while in 2020 the trend was reversed where the inflation declined from 7.6% in January to 5.5% by October.

The NCPI was updated with 2013 kept as the base year and we have now seen a cumulative 39.1% increase in prices. It is to be noted that years 2017 & 2019 are the highest contributors to this increase.

Interest Rates: All interest rates declined in 2020 against 2019. The benchmark AWPLR declined significantly over the past 12 months to virtually unprecedented levels. The AWPLR declined further in December and the weekly rate hovers around 5.66% at the time of writing.

Exchange Rates: The Sri Lankan Rupee (LKR) depreciated against most currencies during the year. However, it appreciated against the Russian Rouble, Turkish Lira and Ukrainian Hryvnia, which was not good news for the tea trade.

MARKET OUTLOOK FOR 2021

( In projecting a possible market scenario, the following needs due consideration)

▪ As many tea producer countries continue to promote ‘tea drinking,’ the percentage of tea retained in producer countries have increased quite significantly over the last decade, resulting in a declining availability for exports.

▪ Tea consumption continues to be dominated by Asian countries, particularly India and China, which together is estimated to be 55% and more of global demand.

▪ Out of home consumption, which was adversely impacted due to Covid-19 is likely recover to some extent in 2021, particularly as the year progresses.

▪ Weak market outlook from European countries following the economic downturn, which is unlikely to impact tea prices in a significant manner.

▪ Uncertainty about US trade policy towards China poses a risk to tea sales. It is hoped that US policy will become less combative with the political change.

▪ Oil prices moved higher during the first two weeks of December based on stronger Asian demand, effective OPEC+ supply management and positive news on the vaccine front, whilst Brent oil crossed USD 50 for the first time since March.

▪ From a Sri Lankan perspective, it is most likely that the Sri Lankan Rupee would weaken once the imports on non-essential items are relaxed and in such circumstances, would augur well for Rupee tea prices considering that some of the key importer country currencies too have depreciated post the Covid-19 pandemic.

▪ Sri Lankan tea output although is likely to recover in 2021, is unlikely to achieve the highs registered from 2010 to 2015. Therefore, the supply situation would continue to remain tight.

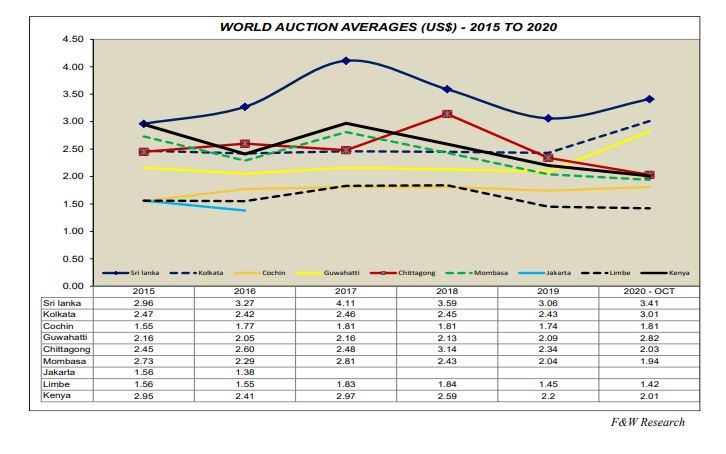

From a global perspective, tea production in 2020 is likely to record a deficit reflecting the crop shortfall primarily from India and Sri Lanka. Kenya, on the other hand, has recorded a fairly significant increase year-on-year, perhaps reflecting a cyclical recovery after a drought induced decline in 2019. Further, black tea production growth over a period of time has essentially been from the African Region, consisting mainly of CTC teas. From an Orthodox perspective, Sri Lanka as a prime supplier together with India and Vietnam have experienced a crop shortfall in recent times.

In the absence of a global measure of tea stocks, predicting tea prices becomes a near impossibility. Therefore, if the supply and demand equation would be a deciding factor, it would be reasonable to assume that prices in respect of Large Leaf Orthodox teas would sustain at these levels, perhaps even as a worse case scenario. However, prices for Orthodox Rotovane (Small Leaf liquoring teas) would largely weigh on the recovery of tea production in North India, which is unlikely to be regularised during the 1 st quarter of 2021 as almost all producer countries experience dry weather conditions and often is a lean cropping period.

In these circumstances, tea prices are unlikely to show a dramatic change from its current levels up until end 1st quarter 2021 and perhaps on a cautiously optimistic note, we could expect these levels to remain till around mid2021. Tea prices thereafter would largely depend on the supply scenarios that unfold during the 1st quarter of 2021.

Amidst the optimistic outlook for prices, the industry continues to be challenged with constant wage increases and lower rates of mechanisation, which would continue to undermine the competitiveness due to higher average production costs than other large producer/exporter countries.

Video Story