December, 14, 2023

By Dr Lakmini Fernando

Realising Sustainable Development Goals (SDGs) by 2030 requires substantial investment allocation, especially for developing economies like Sri Lanka. A recent IPS study found that Sri Lanka needs an additional investment of USD 1.4 trillion or 12.5 percentage points of GDP by 2030 to achieve SDGs. Despite Budget 2024 allocating 5.4% of GDP for public investment, concerns arise due to the historical average of 3.4% of GDP during 2022-2023.

SDG Financing Challenges

Debt repayment commitments, widening primary deficits and poor domestic resource mobilisation will collectively make development financing a daunting task. Scantiness in SDG financing is not unique to Sri Lanka. Despite its undeniable importance, SDGs have never received adequate financial support on a global basis.

Fiscal policy is said to be more influential in advanced economies where public investment and tax revenue increase with per-capita incomes. However, the role played by public investment in developing economies cannot be overlooked, as it stimulates economic activity and attracts private investments to the country.

In overcoming the SDG financing gap, Sri Lanka could look for non-debt creating alternative financing mechanisms like blended financing, international tax reforms, globally earmarked taxes, increased official development assistance and giving pledges. As governance quality positively correlates with investment inflow, attempts to improve governance by combatting corruption and increasing transparency would enhance Sri Lanka’s eligibility to receive these funds.

Sri Lanka Needs ‘Positive Changes’

Capturing Socio-Economic Underdevelopments: In general, the advanced economies are closer to achieving SDGs than any other country group. According to the SDG index that measures the overall SDG performance, Sri Lanka recorded an above-world average score of 0.72 and 0.16 before and after the pandemic. Considering the severity of multiple crises, this progress creates much ambiguity on the sensitivity of SDG monitoring and reporting mechanisms. If we are to capture true development challenges, the existing systems might need serious modifications.

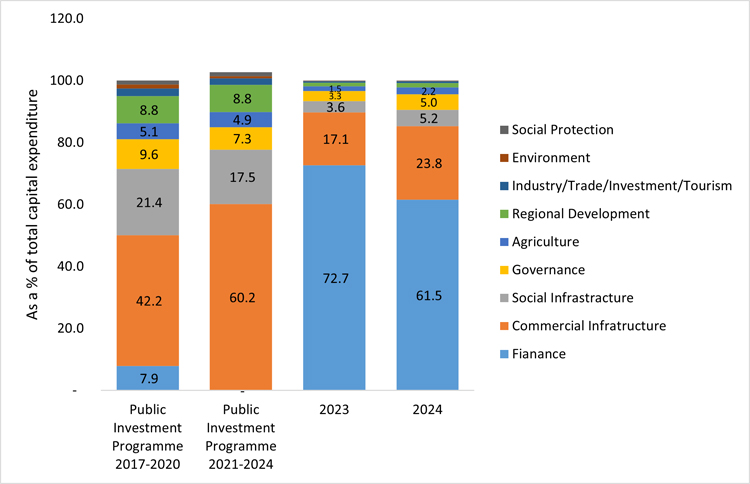

Sustainable Investment: Advanced economies spend the most on education and health. On average, education and health spending in advanced countries lies at 5.2% and 7.8% of GDP in 2019, while the same for Sri Lanka is only 1.9% and 1.6%, respectively. Sri Lanka’s public investment ratio in the three pillars of sustainability: economic, social and environment is 80:19:1. Of which, physical infrastructure development attracts the largest investment share. These discrepancies are even visible in the Budget 2024. A single Ministry, the Ministry of Finance, Economic Stabilisation and National Policies, receives 62% of total capital expenditures while only the balance 39% is shared among 29 other line ministries, including health, education and environment (Figure 1).

Investment spending does not necessarily support productive asset accumulation due mainly to the weak institutions and corrupt bureaucracies in developing countries. Bureaucrats falsely report high-quality, high-cost procurement, while providing low-quality and low-cost products. Thus, public investment quality declines while spending continues to escalate. To enhance public investment quality, it is essential to deviate from usual practices and adopt positive changes: create a culture of evidence-based policy formulation, establish a science-based project proposal appraisal system, restrict budgetary financing to priority projects, strengthen monitoring and evaluation mechanisms, feed project evaluation findings to development project appraisals and maintain healthy work ethics that recognises the development needs of the country.

Figure 1: Sri Lanka’s Capital Expenditure Distribution

Sources: Public Investment Programme 2017-2020, 2021-2024 and Budget Estimates 2024

Maintaining Stable Public Institutions: Frequent institutional changes and duplication of institutions can reduce work efficiency while increasing resource wastage. Instead, continuous capacity improvement in the public sector and establishing healthy work ethics will be more influential in bringing positive development change.

Introducing Development Transformations: The crises create an opportunity to introduce development transformations. For instance, poor maintenance increases rehabilitation and replacement costs by 50% to 60% in the transportation and water and sanitation sectors. Hence, rather than implementing new projects, asset maintenance would be more cost-effective. Yet, maintenance-budgets are always underfunded. By building sectoral expertise in line ministries and local governments, bringing meaningful improvements to existing work-flow would become much easier.

SDGs: A Framework of Hope

Sri Lanka intends to become a developed country by 2048. In designing the national development framework, SDGs could be used as a foresight planning tool to support this vision. In doing so, mainstreaming SDGs into the national development agenda and extending 2030 targets to match national development goals would be the first steps.

The technical and financial assistance that comes with SDGs should be used for qualitative improvements in almost all development sectors and the capacity enhancement of the public sector. So, the understanding of policymakers and development practitioners on the nature and the level of change is pivotal. In solving the development puzzle, the use of external knowledge and expertise should be focused on improving the local talent to avoid over dependence.

A broader vision that goes beyond the ‘western suburbs’ is imperative in achieving the SDGs’ core objectives that bring inclusive and sustainable development. This will be a success if the development vision speaks a common language that comprehends the needs of both rich and the poor in an equitable way. Subsequently, choosing a long-term sustainable development trajectory over short-sighted popular economic gains would eventually enhance the quality of life for all.

Find more insights in our latest publication, ‘Public Investment for Closing the SDG Financing Gap: Sri Lankan Perspective’ by Dr Lakmini Fernando: https://bit.ly/40Zhdhm

Link to original blog: https://www.ips.lk/talkingeconomics/2023/12/13/public-investment-for-sdg-financing-in-sri-lanka-reality-or-myth/

Dr Lakmini Fernando is a Research Fellow at IPS with primary research interest in Development Economics, Public Finance and Climate Change. She has expertise in econometric data analysis, research design and causal methodologies. Dr Fernando holds a BSc in Agriculture from the University of Peradeniya, a Master of Development Economics (Advanced) from the University of Queensland, Australia and a PhD in Economics from the University of Adelaide, Australia.

Video Story