March, 28, 2024

By Chaya Dissanayake and Rashmi Anupama

The global demand for Electric Vehicles (EVs) is projected to reach a staggering 80 million units by 2050, with the United States (US) alone expected to demand one million of these annually. This rising global demand will lead to a hike in the need for natural and synthetic graphite. Considering the US imposing restrictions on Chinese imports, non-Chinese graphite suppliers, including Sri Lanka stand to gain.

A new IPS study underscores Sri Lanka's comparative advantage in graphite exports despite its currently modest output and relatively higher prices for vein graphite compared to China. The study suggests moving towards a free trade agreement/ mineral trade agreement for exporting graphite, especially with US partners would be ideal for Sri Lanka to leverage the benefits from the US’ Inflation Reduction Act (IRA). The publication of this study titled ‘Trade Wars in Electric Vehicle Supply Chains: A Win for Sri Lanka’s Graphite Industry?’ by IPS researchers Dr Asanka Wijesinghe, Malisha Weerasinghe and Chaya Dissanayake at IPS recently featured an engaging discussion with key figures in Sri Lanka's mineral and EV component manufacturing industry. This article is based on the discussion highlighting implications and opportunities for the country's graphite industry.

Technological Competitiveness and Sri Lanka’s Strategic Position

Professor Anura Wijayapala, an eminent electrical engineer from the University of Moratuwa and a former director of the Ceylon Electricity Board (2015-2017) pointed out that Sri Lanka’s strategic advantage lies in upstream value chain products (value-added products) within the EV market. The current graphite content of Sri Lanka is around 1.5 Mn tonnes, which is not adequate to meet the US demand. He stated that Sri Lanka could benefit from the high market prices for graphite by branding Sri Lankan graphite as better quality and produced through environmentally friendly and sustainable practices.

Even with the IRA, Chinese electric cells will prevail in the global market. As the IPS study reveals, China dominates all the nodes in EV vehicle production. Sri Lanka might instead benefit from partnering with ASEAN countries where other Critical Raw Materials (CRMs) are found and who have Free Trade Agreements (FTAs) with the US. Another option is to produce graphite or anodes for the Indian EV market.

Figure 1: Distribution of critical minerals used in EV battery manufacturing excepting Nickel and Aluminum metals and the countries which are eligible for concessions under US IRA

Source: Authors’ compilation

Reducing Costs and Enhancing Production

Mr Amila Jayasinghe, CEO, Bogala Graphite PLC shared that the current high prices of Sri Lankan graphite are due to the depth of the deposits in the few operational mines within the country. Reducing the depth of operation to 10-20 m from the surface could considerably lower the cost of mining, which can be done by expanding mining operations to new mines, provided adequate regulations are in place.

Challenges such as the transparency of the process to obtain mining permissions from relevant authorities deter potential foreign investment. The royalty fee for value-added graphite in Sri Lanka encourages the export of raw graphite to foreign anode producers as it is cheaper, which is not beneficial to the local producer.

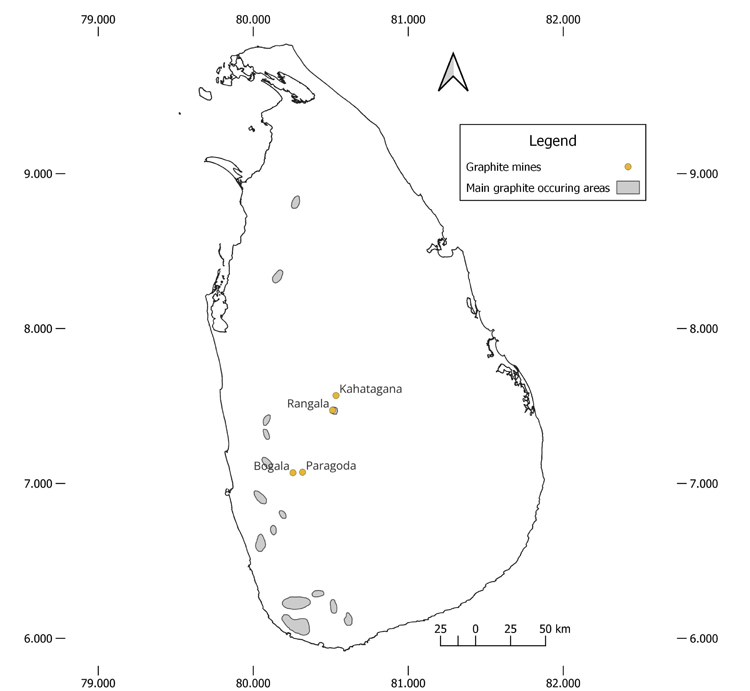

Figure 2: Known graphite deposits in Sri Lanka and locations of active graphite mines

Source: Authors’ compilation

Government Initiatives to Link Sri Lanka to Global Value Chain

Mr Akila de Zoysa, Deputy Director of Export Services at the Export Development Board of Sri Lanka (EDB), discussed government initiatives to link local manufacturers with global value chains, highlighting the potential of graphite value addition. For example, graphene production, which is extracted from graphite, has a higher market value and demand. However, graphene production is costly and requires investments to develop into a profitable industry.

On a positive note, a multinational company with Sri Lankan origins plans to launch an EV battery assembly plant in Sri Lanka in partnership with a Swedish company. The EDB is exploring the possibility of connecting local graphite manufacturing companies with this corporation for the battery manufacturing process. Additionally, there are several local companies which are currently assembling EV vehicles with more than 35% value addition within the country.

Global Implications and Tapping into Green Technology

Relocation of industries to other countries in the aftermath of the economic crisis makes it challenging to attract new investments. There are also geopolitical concerns to entering into a CRM agreement with the US given the current hostilities between China and the US. However, Sri Lanka can circumvent theses complications by cooperating with Vietnam or Southeast Asian nations with FTAs with the US. Alternatively negotiating a comprehensive CRM agreement with the US on graphite exports like the US-Japan CRM agreement might also provide a more diplomatic avenue to profit from IRA.

Sri Lankan graphite production is comparatively a green process. Certain other manufacturing industries in Sri Lanka are already making use of renewable energy usage to market their products to environmentally conscious buyers. About 50 % of Sri Lanka’s electricity is renewable and the greenhouse gas emission in Sri Lanka is also comparatively low compared to many other countries which may help label Sri Lanka’s graphite as “green graphite”.

Success for the Sri Lankan graphite industry hinges on competitive positioning, strategic international partnerships, and green manufacturing practices. As the electric vehicle market continues to expand, Sri Lanka's graphite industry could indeed emerge as a key player in the global supply chain, provided it navigates the path with strategic foresight and innovation.

Learn more in our latest publication ‘Trade Wars in Electric Vehicle Supply Chains: A Win for Sri Lanka’s Graphite Industry?’ by IPS researchers Dr Asanka Wijesinghe, Malisha Weerasinghe and Chaya Dissanayake.

Chaya Dissanayake is a Research Assistant at the Institute of Policy Studies of Sri Lanka (IPS). She holds a B.Sc. (Hons) in Agriculture specialised in Agricultural Economics from the University of Jaffna and is currently reading for an MSc in Integrated Water Resource Management at the Postgraduate Institute of Agriculture, Peradeniya. Her research interests include agricultural policies and institutions; disaster risk management; poverty and inequality; SMEs; women and the workforce.

Rashmi Anupama is a Project Officer at the Institute of Policy Studies of Sri Lanka (IPS) with research interests in macroeconomics and international trade. She holds a BSc in Agriculture specialising in Agricultural Economics with a first class from the Rajarata University of Sri Lanka.

Video Story