April, 2, 2024

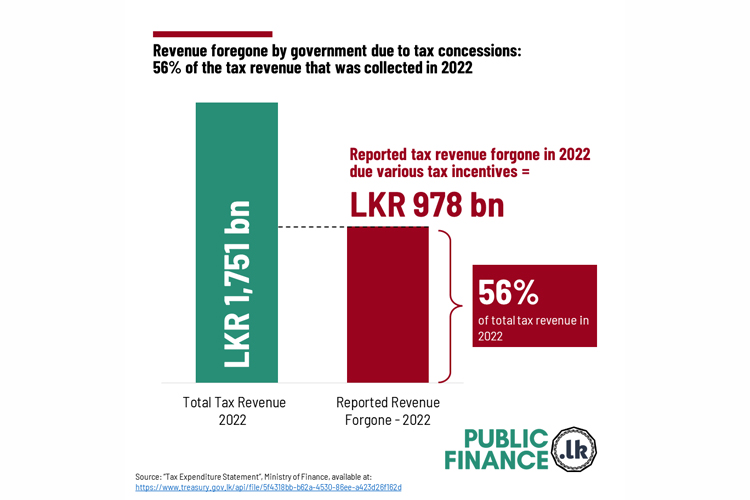

For the fiscal year 2022/23 (April to March), tax concessions resulted in a total of LKR 978 billion in foregone revenue, the government reported yesterday (31 March).

The foregone revenue amounts to 56% of the total tax revenue collected by the government in 2022.

This was highlighted by PublicFinance.lk, Sri Lanka’s premier economic insights platform, maintained by Verité Research.

The source was a document titled “Tax Expenditure Statement” published on March 31, 2024 by the Ministry of Finance of Sri Lanka.

The document reports the government’s estimates of the total revenue foregone due to various special targeted tax concessions provided by the country. The disclosure states its purpose as “to improve transparency in Sri Lanka’s financial reporting, aligned with international best practices”.

The government also committed in the IMF programme to publish on a semi-annual basis “a list of all firms receiving tax exemptions through the Board of Investment and the SDP [Strategic Development Projects Act], and an estimation of the value of the tax exemption”. The due date for initiating these disclosures was March 2023. It was recorded as “not met” by the “IMF Tracker” (available at: https://manthri.lk/en/imf_tracker) as of the last update on February 2024.

Find the relevant PublicFinance.lk blog post at: (https://bit.ly/3TIEctP)

Government report: (https://bit.ly/4aB60ad)

Video Story