October, 15, 2024

By Priyanka Jayawardena

Earlier this year, Sri Lanka introduced major changes to the Value Added Tax (VAT) system. The VAT rate increased from 15% to 18%, and tax exemptions were removed for 97 items, including essential goods such as gas and stationery. While these revisions aimed to boost government revenue, they have also significantly increased the tax burden on low-income households, making life even more challenging for the most vulnerable during this ongoing crisis. This blog offers a comprehensive overview of the recent VAT revision and potential solutions for easing the VAT burden in Sri Lanka.

The Rise in VAT Burden

The VAT rate hike from 15% to 18% has translated into a 20% rise in VAT payments overall. A VAT simulation analysis based on Household Income and Expenditure Survey (HIES) 2019 data reveals that when combined with the removal of tax exemptions, the average VAT burden has increased by about 50%. However, this burden is not evenly distributed. The poorest 40% of households face an approximate 60% rise in VAT payments, while other income groups experience around a 50% increase.

Who Bears the Brunt of the VAT Revision?

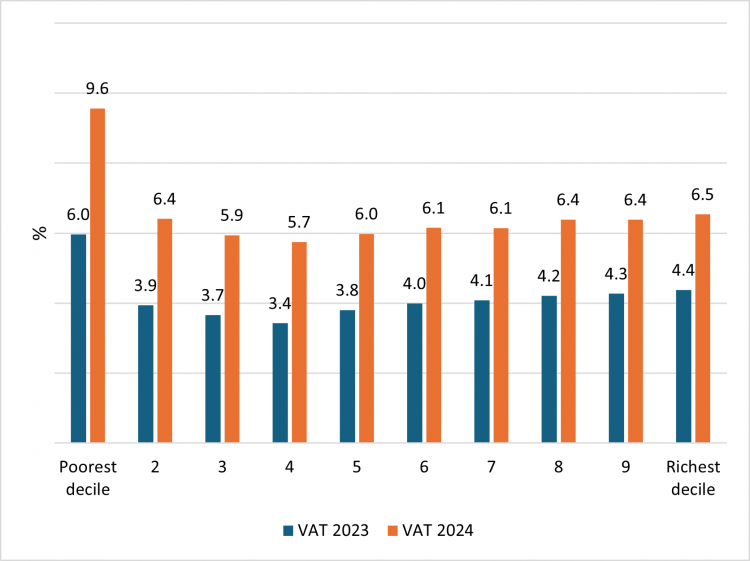

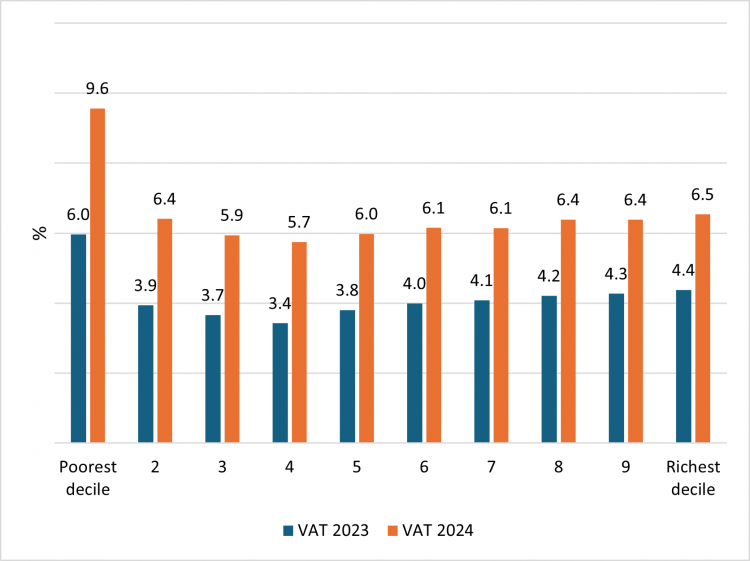

The harshest impact of these VAT revisions has fallen on the lowest-income households. The bottom 10% of households now pay around 10% of their income as VAT, up from 6% under the previous VAT system (Figure 1). In comparison, other households spend about 6% of their income on VAT payments. This disproportionate impact is primarily due to the removal of tax exemptions on widely-use items, which are essential for all.

Removing VAT exemptions on 97 items out of the previously exempted 138 has made essential purchases more expensive. Low-income households typically allocate a greater portion of their budgets to essential items that were previously exempted from VAT but are now taxed. These include fuel, gas, telecommunication services, as well as various food products made from locally cultivated grains, locally produced coconut milk, and certain locally produced dairy products.

Figure 1: VAT as a Share of Income - 2023 vs 2024

Source: Author’s calculations, based on HIES-2019 data from the DCS.

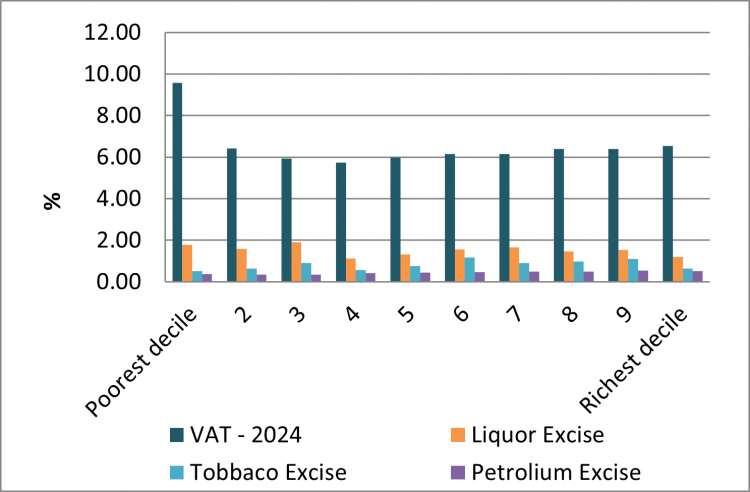

Comparing VAT with Other Indirect Taxes

VAT applies to a wide range of goods and services, affecting all consumers. However, its impact is regressive, taking a larger proportion of income from poorer households compared to richer ones (Figure 2). In contrast, excise taxes on products like alcohol and tobacco are less burdensome on lower-income groups. The top 20% of households contribute 43% of alcohol taxes and 44% of tobacco taxes, while the bottom 40% of households account for 19% of alcohol taxes and 14% of tobacco taxes. Additionally, VAT applies to basic commodities that everyone needs, whereas excise taxes apply to tobacco and alcohol, which are harmful products that contribute to non-communicable diseases (NCDs). In this sense, higher taxes on tobacco and alcohol act like an upfront investment in public health, helping to offset future healthcare costs.

Figure 2: Indirect Taxes as a Share of Income

Source: Author’s calculations, based on HIES-2019 data from the DCS.

What Can Be Done?

While the VAT hike was designed to stabilise Sri Lanka’s finances, it disproportionately affects vulnerable populations. This highlights the need for more balanced and fair fiscal policies. A more equitable approach would ensure that taxation doesn’t disproportionately affect those least able to afford it, preserving economic fairness during difficult times. Addressing the uneven impact of VAT requires exploring policy alternatives, such as reintroducing exemptions for essential goods if necessary. Increasing excise taxes on tobacco and alcohol is a favourable policy option. This could help create a more just system while reducing long-term healthcare expenses.

Priyanka Jayawardena is a Research Economist at IPS with research interests in skills and education, demographics, health, and labour markets. Priyanka has around 15 years of research experience at IPS. She has worked as a consultant to international organisations including World Bank, ADB and UNICEF. She holds a BSc (Hons) specialised in Statistics and an MA in Economics, both from the University of Colombo. (Talk with Priyanka - priyanka@ips.lk)

Video Story