December, 9, 2019

The Government of Sri Lanka (GoSL) reduced variety of taxes substantially in an attempt to revive the economy, which could possibly cost over LKR 500 Bn according to government’s own estimates. Whilst acknowledging the potential boost to the aggregate demand and corporate profitability from the fiscal stimulus in the short-run, ICRA Lanka believes Sri Lanka should broaden the tax base and continue fiscal consolidation to avoid macroeconomic instability to benefit from the tax buoyancy effect.

Vietnam is a case in point where the country’s low tax environment has not translated to increasing tax revenue compared to the size of the economy. In the span of four years from 2012, Vietnam’s tax incentives for businesses accounted for 7% of the total State budget revenue. However, revenue from corporate income tax fell sharply from 6.9% of the GDP in 2010 to 4.3% in 2016.

Sri Lanka is not the only country struggling with sluggish growth in South Asia. India, as of end June, has seen its GDP growth rate fall for six straight quarters. To spur the growth, India introduced the biggest corporate tax reduction in 28 years in September 2019 which could cost 1.45 Tn Indian rupees.

ICRA Lanka’s interviews with a cross section of top business leaders in the country just before the fiscal stimulus revealed the heightened effective tax rates are one of the main factors impeding the profitability and growth of the corporate and finance sectors.

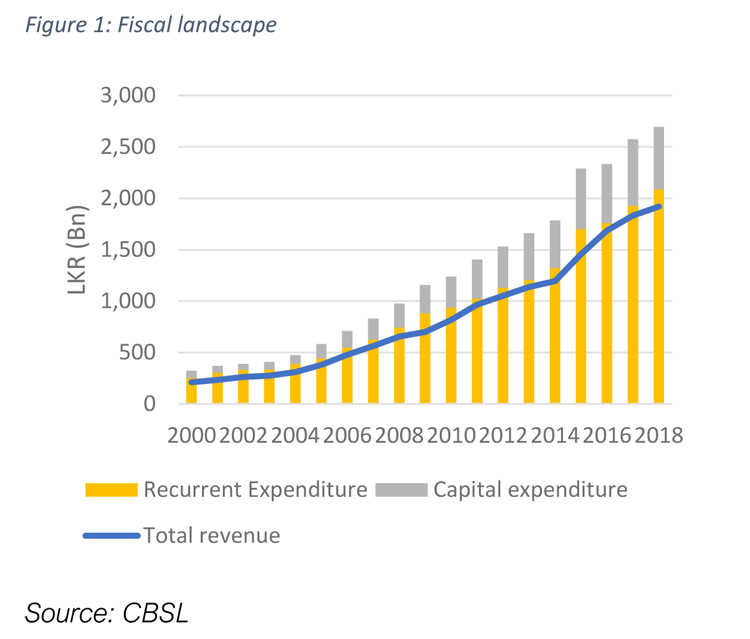

The key problem faced by the GoSL for past few decades is that its recurrent expenditure has been above the total revenue, thereby leading to accelerated debt formation. In the process, much needed capital expenditure, which is critical for longterm economic growth, has not grown substantially. Therefore, growth of recurrent expenditure should be curtailed to the maximum extent possible to avoid facing headwinds to economic growth.

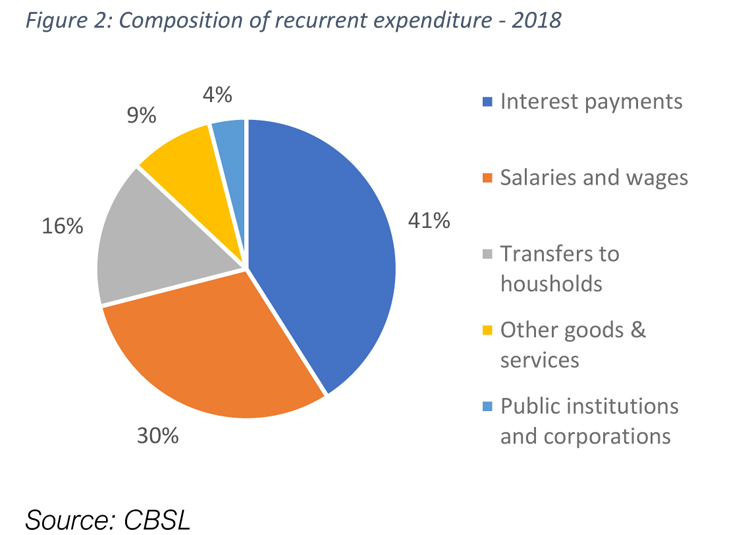

With exploding recurrent expenditure, Sri Lanka has very little fiscal space to reduce the expenditure side. Two largest components of recurrent expenditure, interest payments and salaries and wages, takes up about 71% of the whole item. Sri Lanka spent just over LKR 500 Bn, an amount roughly equal to the fiscal stimulus, on interest payments to treasury bond holders alone in 2018. Reducing interest payment component is extremely challenging amidst a widening fiscal deficit as government requires to continue issuing bonds. ICRA Lanka believes the government should attempt to restructure debt to bring down the debt servicing cost.

30% of the recurrent expenditure goes to pay salaries and wages for public sector employees. There were1.4 Mn employed in the public sector by 2018, up 1% from the year before. It would be critical to control the state sector recruitment to stop further expansion of the salaries and wages component.

Reducing the transfers to households will be difficult, but by improving the efficiency of public institutions and corporations, the government can reduce the cost of transfers to State Owned Enterprises (SOEs). In this context, ICRA Lanka feels that government’s commitment to fiscal consolidation can be seriously undermined by a move such as removing fuel price formula.

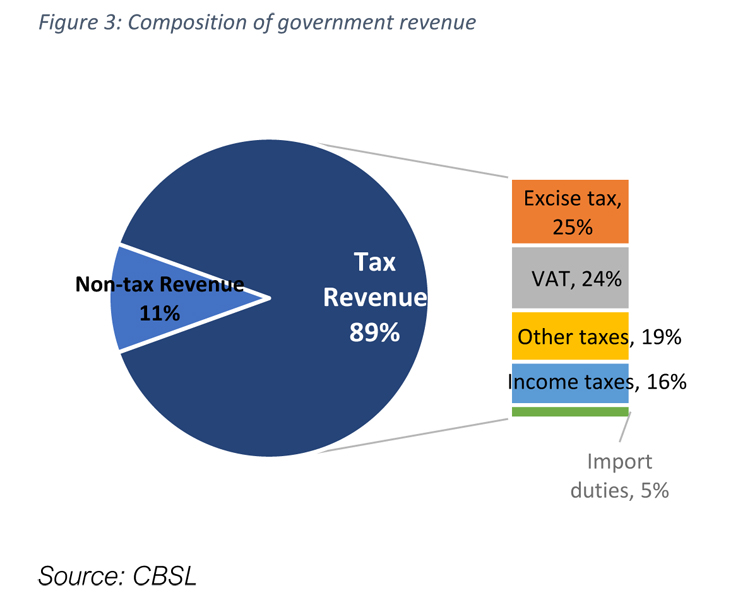

In 2018, the total government revenue was LKR 1.9 Tn. Going by the government’s estimates, the cost of the tax cuts is about one fourth of the total government revenue. Reduction in tax revenue is highly unlikely to be compensated by raising non-tax revenue in the short-run, therefore we expect government may consider raising some taxes to counterbalance the loss in revenue. Furthermore, increasing profitability of SOEs can also improve nontax revenue.

The impact of the fiscal stimulus on the economy cannot be looked at in isolation. Given Sri Lanka’s external debt obligations scheduled for 2020 (US$ 3.7 Bn) and beyond, strengthening of rupee is required for reserve accumulation. More government revenue means lesser requirement for monetary financing consequently preserving the value of the currency. Therefore, importance of enhancing government revenue in the light of current stimulus cannot be left for its own devices.

Given very little fiscal space the government is presented with, the prudent way forward is to expand the tax base to exploit the trickledown effect of the stimulus and to continue fiscal consolidation to curb expansion of the fiscal deficit. Strong consumer sentiment is vital for economic revival but sustaining it in the long-run requires structural reforms and fiscal discipline.

Video Story