November, 17, 2014

In a year that has proved to be record breaking, the Colombo Stock Exchange has reached yet another milestone in 2014 by recording its highest-ever inflow of foreign investment into the equity secondary market. Foreign purchases in 2014 as at 14th November is Rs. 95,083.8 Million surpassing the previous highest foreign purchases of Rs.92, 425. 5 Million recorded in 2010.

The CSE in association with the Securities and Exchange Commission (SEC) initiated a strategy to attract foreign investors to the market, over the past two years. The strategy to conduct road shows in overseas locations has been successful in attracting foreign institutional investors to invest in the Lankan Capital Market. These Forums have generated wide interest amongst international Fund managers and generated tangible results in the form of investments in equity and debt.

The “Invest Sri Lanka” Investor Forums were held in Mumbai, Dubai, Hong Kong, Singapore, London and New York and the purchases originating from these countries account for 60.3 per-cent of overall foreign purchases within 2014. The CSE also attracted new foreign entrants to the market, in 2014, from locations where these Investor Forums were hosted and they accounted for 44.4%.

“The market has been on an upward trajectory in the past year and this has been a steady progressive improvement. We believe that investors entering the market are being cautious and basing their decisions on the fundamentals of companies. Foreign investors therefore have confidence in the liquidity of their investments, this buoyancy is being reflected in the foreign inflow over the past months,” Chairman of the CSE Mr. Vajira Kulatilaka said.

“The Capital Market Conference hosted in October of this year was a culmination of several overseas Investor Forums, over the past two years. It is evident from the institutional and high-net worth investors who visited Sri Lanka and met with listed companies, during the conference, that the Sri Lankan Capital Market is gaining attention and proving to be an attractive investment destination for those looking at PUBLIC

emerging and frontier markets,” CEO of the CSE Mr. Rajeeva Bandaranaike said.

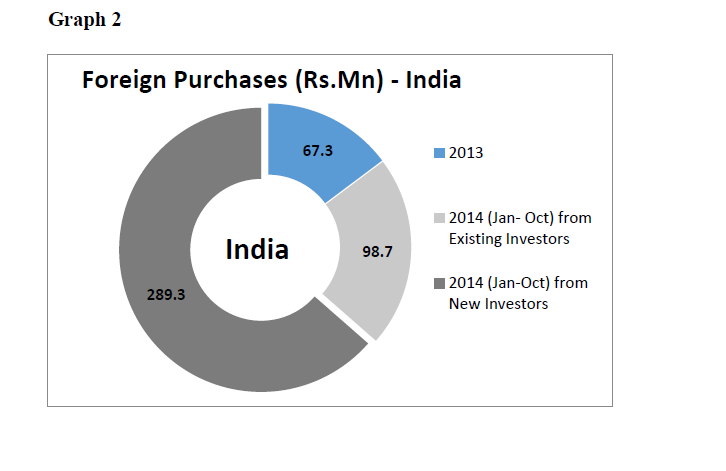

The net foreign flow from each of the countries, where foreign investor forums were held, have shown a positive increase and new investors have been attracted to the market from each location, as demonstrated in the graphs below.

Net Foreign flow from India has increased to Rs. 242.5 Million in the period January to October 2014 ( graph 1), after recording a negative foreign flow in 2013, with a large percentage of this inflow being contributed by new entrants to the market (graph 2).

Similarly a turnaround was witnessed from the United Arab Emirates investors with the negative foreign flow transforming into a positive foreign flow (graph 3) and a significant contribution to this figure coming from new entrants to the market (graph 4)

The contribution from Hong Kong to the capital market has also been positive in the year to date (graph 5 and 6). Comparable to the increased interest from investors in Singapore (graph 7 and 8)

Investors from the United Kingdom showed a remarkable interest in the market with the positive inflow from 2013 showing a phenomenal increase in 2014 (graph 9 and 10).

Contribution to the market from the United States also showed a noteworthy increase in the past two months. A net foreign outflow of Rs. 5,717.7 Million was recorded from the United States during January to September 2014; however subsequent to the “Invest Sri Lanka – Investor Forum” in New York the net foreign flow increased to a positive Rs. 1, 844.3 Million. (Graph 11 and 12).

“It is only in the past 18 months that we have put serious capital to work and that is why I would say now is an excellent time to invest in Sri Lanka. I am very positive about the outlook of the Sri Lankan economy; in my opinion the best economic growth stories are very supply side led, here Sri Lanka can excel adding infrastructure where it did not exist before, Sri Lanka is adding port capacity to leverage its position on east-west shipment routes, developing itself into a transhipment hub, and working on more efficient and powerful power capacity – these very simple improvements will have a very large impact on the productive potential of the economy,” Mr. Gordon Fraser, a Fund Manager, Member of the Emerging Markets Specialists Team, Blackrock said, during the Forum in London this May.

“A criteria we look at, one which Sri Lanka is doing very well is, investment on the scale of GDP; Sri Lanka is there on the above 30 per-cent zone. If you look at all the economic miracles that have taken place in the world, they have taken place on the back of rising economic investment and Sri Lanka’s investment to GDP ratio is very healthy today…The good thing about Sri Lanka is that despite high economic growth, if you look at the private sector debt to GDP ratio and the increase in those, those have been fairly healthy, as far as Sri Lanka is concerned…Another thing I find positive about Sri Lanka is that it is in the geographical sweet spot and this way I think Sri Lanka has done a great job of playing China and India,” Mr. Ruchir Sharma, Head of Emerging Markets, Morgan Stanley Investment Management, said in New York this September.

Video Story