December, 4, 2015

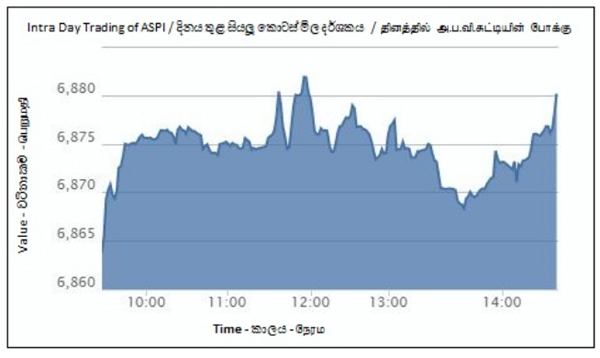

Colombo stock market bounced back to record gains on Thursday, snapping the six day losing streak amid high foreign investor participation. All share index bagged 17.87 index points (+0.26%) to end the session at 6,880.66 while 20-scrip S&P SL index gained 8.35 index points or 0.23% to close at 3,646.10.

Today’s gains were driven by high caps such as Ceylon Tobacco (closed at LKR 1,000.00, +1.0%), Cargills Ceylon (closed at LKR 189.90, +2.7%) and Sri Lanka Telecom (closed at LKR 47.40, +1.1%).

Daily market turnover was LKR 1.3bn. Lion Brewery emerged as the top contributor to the turnover driven by high foreign activity and recorded a turnover of LKR 624mn supported by a single off-the-floor dealing of 0.5mn shares at LKR 630.00. Counter closed with flat returns at LKR 630.00 and accounted for 48% of the total turnover. Asiri Hospital Holdings (LKR 153mn), Ceylon Tobacco (LKR 132mn) and Hatton National Bank (LKR 69mn) were the next best contributors to the turnover.

Several crossings were recorded in Distilleries (0.2mn shares at LKR 270.00), Asiri Hospital Holdings (4.0mn shares at LKR 25.00) and Ceylon Tobacco (0.1mn shares at LKR 1,000.00) and aggregate value of crossings represented 43% of the turnover.

Market breadth was almost equally divided where out of 237 scripts, 90 advanced, 84 slipped while 63 remained unchanged. Cash map advanced from 34% to 36%. 28 stocks declined to 52wk low price levels out of which three were high caps namely DFCC Bank (LKR 155.00), Asian Hotels & Properties (LKR 58.00) and Carson Cumberbatch (LKR 350.00).

Waskaduwa Beach Resort, John Keells Holdings and Commercial Bank were among heavily traded counters.

Following the dividend announcement, Panasian Power advanced to LKR 3.80 but closed lower at LKR 3.60, +2.9%. Meanwhile, most of the tile manufacturers such as Royal Ceramic (+1.0%), Lanka Ceramic (+9.3%) and Lanka Tiles (+0.2%) witnessed positive returns while Lanka Walltiles closed 3.9% below at LKR 102.70.

Foreign investors wrapped the session on buying side with a net foreign inflow of LKR 79mn. Foreign participation continued to remain on higher side with a participation of 83%. Net foreign inflows were seen in Asiri Hospital Holdings (LKR 51mn), Lion Brewery (LKR 37mn), John Keells Holdings (LKR 16mn) while net foreign outflow was mainly seen in Ceylon Tobacco (LKR 47mn).

Lanka Securities Research

Video Story