December, 5, 2015

Colombo Bourse recorded a 5-month low turnover on another lackluster trading session on Friday and concluded the weekly operations on a negative note.

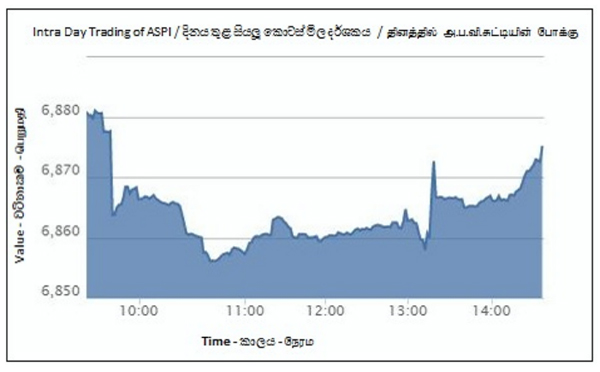

The dull trade pulled the index to a low of 6,856 during the morning session but with the support of gains in several blue-chips, the index managed to recover and close at 6,869.56, down by 11.10 index points or 0.16%. S&P SL20 index declined by 7.54 index points (0.21%) to end at 3,638.56.

Premier high-cap scripts namely Nestle Lanka (closed at LKR 2,075.10, -2.3%), Distilleries (closed at LKR 265.00, -1.7%) and John Keells Holdings (closed at LKR 179.50, -0.7%) pinned the index performance to the negative zone.

Daily market turnover was LKR 373mn. Commercial Bank top the turnover list with LKR 83mn. The counter closed higher at LKR 141.80 as bargain hunters entered the blue-chip which is trading near its 52-wk low. Ceylon Tobacco was the next best contributor to the turnover with LKR 50mn supported by a single crossing of 0.05mn shares at LKR 1,011.00 which accounted for 13% of the total turnover. Hatton National Bank (LKR 44mn), John Keells Holdings (LKR 41mn) and Hemas Holdings (LKR 15mn) were among top contributors to the turnover.

The market breadth was positive where 93 counters advanced, 66 declined while 55 counters remained unchanged. However cash map declined from 36% to 28%. Out of 214 counters traded, 27 counters touched 52wk low price levels.

Lanka Hospitals attracted high investor preference following the acquisition interest announced by the Hemas Holdings. Lanka Hospital counter advanced to LKR 61.90 but close with a gain of 3.4% at LKR 61.00 while Hemas Holdings end the trading session with a marginal increase of 0.2% to close at LKR 85.10.

Ceylon Grain Elevators, Waskaduwa Beach Resort and Access Engineering were among heavily traded counters. Meanwhile, On’ally Holdings declared interim dividend of LKR 1.10 per share.

Foreign investors were net sellers with a net foreign outflow of LKR 13mn, snapping the four day net inflow streak. Foreign participation declined from 83% to 38%. Net foreign outflows were seen in Commercial Bank (LKR 91mn), Hemas Holdings (LKR 10mn), Seylan Bank (LKR 2mn) while net foreign inflow was mainly seen in Ceylon Tobacco (LKR 49mn).

During the week, main index shed 91.85 index points or 1.32% while S&P SL 20 index declined by 65.48 points (-1.77%). Mahaweli Reach Hotels (10%), Kelani Cables (4%), Anilana Hotels & Properties (2%) were among the top gainers of the week while Hayleys Fibre (-13%), Ceylon Grain Elevators (-7%), Asia Asset Finance (-6%) were among the top losers.

The average weekly turnover advanced by 33% to LKR 915mn. John Keells Holdings topped the weekly turnover list with LKR 1.8bn followed by Lion Brewery (LKR 634mn) and Ceylon Tobacco (LKR 387mn).

The foreign investors stood on the buying side during the week recording a net foreign inflow of LKR 317mn. Foreign activity was at 72%. Net foreign inflows were mainly seen in John Keells Holdings (LKR 141mn), Asiri Hospital Holdings (LKR 91mn), People’s Leasing & Finance (LKR 81mn) while net foreign outflows were mainly seen in Commercial Bank (LKR 203mn) and National Development Bank (LKR 14mn). Subsequent to this week’s net foreign inflow, year-to-date net foreign outflow decreased to LKR 3.5bn.

Video Story