January, 5, 2016

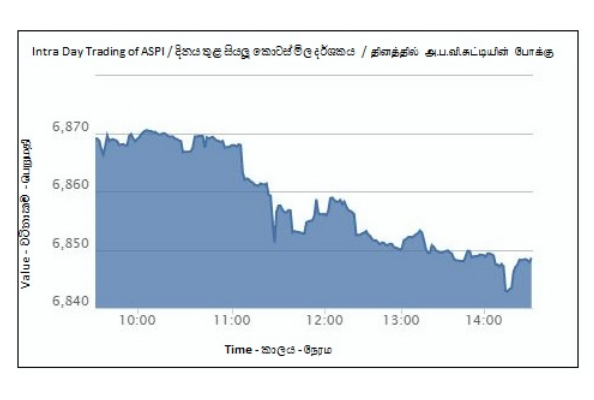

Colombo bourse continued its negative trend for the second consecutive day of the New Year. Investor participation was on the low side, while Dialog Axiata, being an exception, contributed to 60% of the daily market turnover. Benchmark index closed at 6,845.30, a decline of -22.32 index points or -0.33%, while the S&P SL20 index shed -12.63 index points or -0.35% to end at 3,586.25.

Today’s top positive contributors to the index were high caps namely Commercial Leasing & Finance (closed at LKR 4.20, +5.0%), Asiri Hospital Holdings (closed at LKR 24.00, +4.4%) & Aitken Spence (closed at LKR 93.40, +2.6%). The top negative contributors that depreciated the index performance was Sri Lanka Telecom (closed at LKR 46.40, -1.3%), followed by Ceylon Tobacco (closed at LKR 980.00, -1.3%) and DFCC Bank (closed at LKR 162.30, -3.5%).

Daily market turnover was a mere LKR 561mn. Dialog topped the turnover list with LKR 335mn under pinned by 10 crossings of 30.4mn shares at LKR 10.50. Further, two crossings were recorded in People’s Leasing & Finance where 5.0mn shares at LKR 21.50. Accordingly, aggregate value of crossings accounted for 76% of the total turnover.

People’s Leasing & Finance (LKR 109mn), Textured Jersey (LKR 10mn) and Hatton National Bank (LKR 8mn) were next best contributors to the total turnover.

Market breath looked unimpressive where out of the 236 counters that traded, 104 spiraled down, 72 advanced and 60 counters remained unchanged. Cash map marginally increased from 38% to 43%. The 23 counters that reached 52wk low prices included blue chips such as Commercial Bank (LKR 138.50) and Chevron Lubricants (LKR 399.00), while the 4 counters that reach 52wk high price levels included Textured Jersey (LKR 36.30).

Entrust Securities was taken over by the Central Bank of Sri Lanka as it was unable to meet deadlines assigned to assemble a viable and credible restructuring program and the management of the company has been handed over to the National Savings Bank. The drop in investor confidence relating to this incident was depicted in the price of Multi Finance (a related entity to Entrust Securities), as it dropped to a 52wk low price of LKR 17.10, -10.5% Further a trading of the counter has been halted pending clarification from the company.

Foreign investors were net sellers for the second consecutive day with a net foreign outflow of LKR 296mn. Foreign participation was 48%. Net foreign outflows were seen in Dialog Axiata (LKR 297mn), Hatton National Bank (LKR 7mn), Commercial Bank (LKR 2mn) while net foreign inflow was mainly seen in Overseas Realty (LKR 3mn).

Video Story