November, 9, 2015

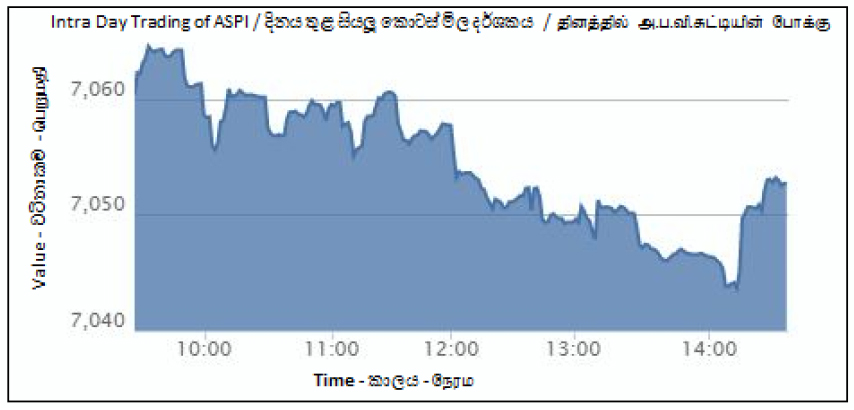

Colombo stock market started weekly operations with a lackluster trading session where benchmark index witnessed losses to snap the three day winning streak. All share index shed 9.27 index points (-0.13%) to close at 7,050.21 while 20-scrip S&P index declined by 0.07% (-2.65 index points) to close at 3,821.97.

Price declines in blue-chips such as John Keells Holdings (closed at LKR 184.00, -1.1%), Lanka Orix Leasing & Company (closed at LKR 94.70, -1.0%) and Distilleries (closed at LKR 275.50, -1.6%) contributed negatively to the index performance.

Daily market turnover was LKR 492mn. John Keells Holdings topped the turnover list with LKR 136mn followed by Commercial Bank (LKR 125mn), Distilleries (LKR 28mn) and Sampath Bank (LKR 23mn) respectively. Single crossing was recorded in Distilleries where 0.1mn shares changed hands at LKR 278.00 and accounted for 6% of the total turnover.

Market breadth was negative where out of 234 counters, 107 slipped, 70 advanced while 57 remained unchanged. Despite the losses, cash map improved from 46% to 62%. 02 counters advanced to 52wk high prices while 14 counters touched 52wk low price levels.

Subsequent to the conclusion of share repurchase in Resus Energy, the counter attracted heavy investor preference. Stock increased to LKR 26.00 but closed lower at LKR 24.80 (+0.8%). Further, John Keells Holdings, PC Pharma and Textured Jersey were among heavily traded counters.

Despite the positive results of Ceylon Tobacco and the dividend announcement, the script witnessed marginal returns to close at LKR 985.00, +0.5%.

Foreign investors were net buyers with a net foreign inflow of LKR 64mn. Foreign participation was 53%. Net foreign inflows were seen in John Keells Holdings (LKR 73mn), Overseas Realty (LKR 4mn), Textured Jersey (LKR 4mn) while net foreign outflows was mainly seen in Sampath Bank (LKR 22mn).

Lanka Securities Research

Video Story