November, 11, 2015

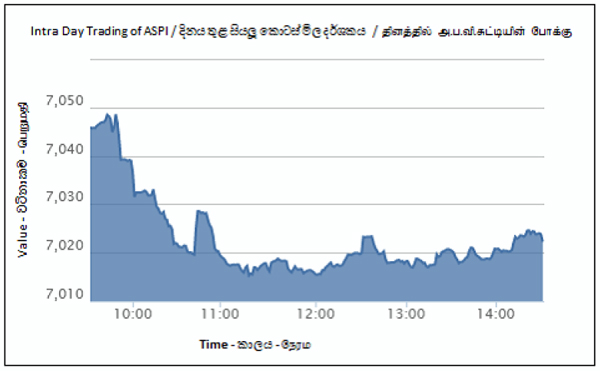

Colombo bourse extended losses for the second consecutive day as investor remained on sidelines ahead of the budget 2016. All share index shed 30.98 index points or 0.44% to close at 7,019.23 while 20-scrip S&P SL index declined by 0.82% (31.36 index points) to end at 3,790.61.

Today’s losses were mainly driven by blue-chips such as Aitken Spence (closed at LKR 99.00, -0.3%), Chevron Lubricants (closed at LKR 360.00, -3.3%) and Distilleries (closed at LKR 275.00, -1.1%).

Daily market turnover was LKR 547mn. John Keells Holdings topped the turnover list with LKR 170mn followed by Resus Energy (LKR 60mn), Lanka Hospitals (LKR 53mn) and Panasian Power (LKR 48mn) respectively. Single crossing was recorded in Panasian Power where 10mn shares changed hands at LKR 3.80 per share.

Losers offset the gainers, 119 to 66 while 63 counters remained unchanged. Cash map slide from 62% to 46%. 04 counters managed to reach 52wk high prices while 25 counters declined to 52wk low price levels.

Resus Energy, Lanka Hospitals and Textured Jersey counters attracted heavy investor preference where all three counters advanced to fresh 52wk prices. Lanka Hospitals continued to post gains for the third consecutive day and counter reached a 52wk high price of LKR 60.70 but closed at LKR 60.50, +10.2%. Meanwhile, Textured Jersey and Resus Energy stepped to a fresh 52wk high price of LKR 34.80 and LKR 26.60 and closed at LKR 34.10, +0.9% and LKR 26.50, +6.4% respectively.

Chevron Lubricants witnessed heavy losses on its XD date of the third interim dividend. Counter declined by 3.3% to close at LKR 360.00. Further, high cap banks namely Hatton National Bank, National Development Bank, Sampath Bank, DFCC Bank and Commercial Bank closed session with negative returns. Commercial Bank touched a 52wk low price of LKR 154.00.

Despite the favourable profit growth reported in Hayleys and Asiri Hospitals, both counters closed lower at LKR 310.10 (-1.8%) and LKR 23.50 (-0.4%) respectively. Moreover, net earnings of Dialog Axiata declined by 60%YoY while counter slipped marginally by 0.9% to LKR 11.10.

Foreign investors closed session on buying side with a net foreign inflow of LKR 126mn. Foreign participation was 27%. Net foreign inflows were seen in John Keells Holdings (LKR 102mn), Textured Jersey (LKR 22mn), Piramal Glass (LKR 2mn) while net foreign outflow was mainly seen in Resus Energy (LKR 3mn).

Meanwhile, at today’s Treasury bill auction, one year T-bill yields declined by 6bps from 7.00% to 6.94% while 6 months tbills were rejected. CBSL offered LKR 20bn worth of Treasury bills today and the auction was oversubscribed by 4.4 times with bids received amounting to LKR 89bn. It was decided to accept LKR 5.8bn worth of bills.

Lanka Securities Research

Video Story