January, 18, 2016

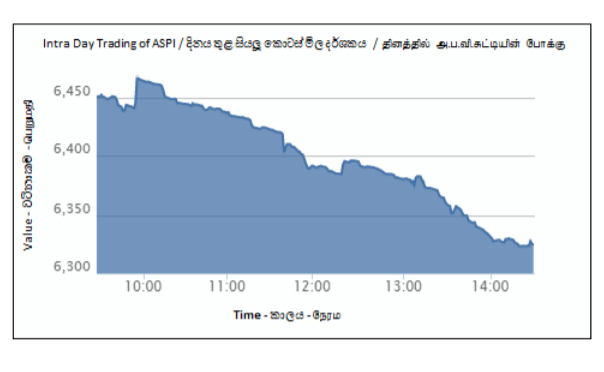

Colombo bourse extended the pessimistic sentiment on the opening day of the week as core index shed 1.89%. Main index declined to an 18 month low of 6,324.61, down by 121.59 index points while high cap constitute S&P SL20 index declined by 1.67% or 55.77 index points, where all the banks and finance stocks in the index dropped to a 52wk low price levels.

Price depreciation in market premier, John Keells Holdings (closed at LKR 160.70, -2.7%) and high caps namely, Lanka Orix Leasing (closed at LKR 75.00, -7.2%), Ceylon Cold Stores (closed at LKR 380.00, -5.0%) and Distilleries (closed at LKR 215.00, -2.7%) pinned index performance on red territory.

Daily market turnover was moderate but failed to cross the YTD average daily turnover to LKR 813mn. Three off-the-floor dealings in John Keells Holdings managed to secure the highest turnover position with a contribution of LKR 331mn. 0.8mn shares of JKH changed hands at LKR 164.00-165.00 and accounted for 16% of the total turnover.

Aitken Spence Hotels Holdings (LKR 73mn), Hemas Holdings (LKR 29mn) and National Development Bank (LKR 25mn) were among top contributors to the turnover.

Reflecting the adverse performance, out of 253 counters traded today, 120 declined to 52wk low price levels. Most of the banks such as Commercial Bank (LKR 129.00), National Development Bank (LKR 170.00), DFCC Bank (LKR 152.00), Hatton National Bank (LKR 195.00) and Sampath Bank (LKR 220.00) recorded 52wk lows.

Gainers outweighed the losers, 202 to 25 while 26 counters remained unchanged. Cash map declined from 32% to 17%.

High investor activity was witnessed in both John Keells Holdings and John Keells Holdings warrant 0023. Further, Textured Jersey, Ceylon Grain Elevators and Richard Pieris were among heavily traded stocks for the day.

Foreign investors closed the session on selling side with a net foreign outflow LKR 151mn. Foreign participation was 23%. Net foreign outflows were seen in John Keells Holding (LKR 191mn), Aitken Spence Hotels Holdings (LKR 5mn), Sampath Bank (LKR 4mn) while net foreing inflow was mainly seen in Overseas Realty (LKR 19mn).

Video Story