December, 29, 2015

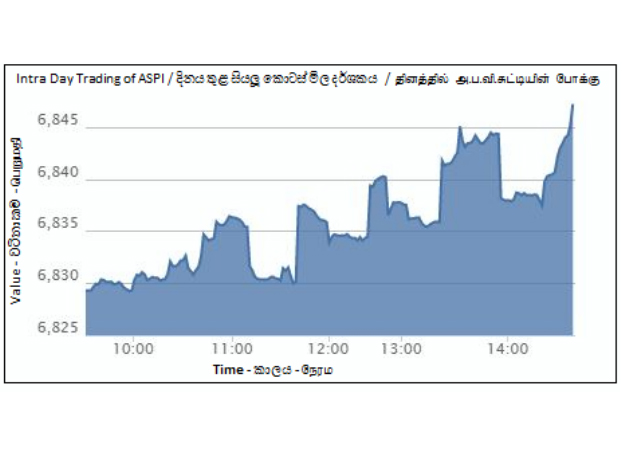

Colombo bourse drifted up in thin, choppy trade on Tuesday marking another lackluster trading session. The market remained largely inactive with turnover failing to exceed LKR 400mn in the last five sessions as the investors refrain from taking large positions at the year-end amid the mixed outlook for 2016.

ASI gained 19.23 index points (+0.3%) to close at 6,847.74 driven by price increase in Sri Lanka Telecom (LKR 47.50,+3.7%), John Keells Holdings (LKR 178.90,+1.1%) and Commercial Leasing (LKR 4.00,+5.3%). S&P SL 20 index gained 9.01 index points (+0.3%) to close at 3,597.65.

Market breadth was mixed with 99 gainers, 84 losers while 66 remained unchanged. Cash map weakened further from 44% to 34%. 19 counters touched 52 week low prices while only Serendib Land managed to touch 52 week high price of LKR 2,200.00,+22.2%.

Market turnover was LKR 307mn. Foreign selling in Commercial Bank shares drove the turnover of the counter to LKR 153mn while Softlogic Holdings and John Keells Holdings made contributions of LKR 43mn and LKR 34mn to the turnover. Negotiated transactions were recorded in Softlogic Holdings (2.7mn shares at LKR 15.80) and John Keells Holdings (0.13mn shares at LKR 178.00). Crossings accounted for 22% of the turnover.

Subsequent to the announcement of the share split, shares of Autodrome attracted retail investor interest and the counter closed at LKR 1,198.00,+24.7%. Further, investor activity was high in shares such as Access Engineering (LKR 23.40,+0.3%), Textured Jersey (LKR 35.60,+0.3%) and Sanasa Development Bank (LKR 158.40,+1.5%).

Abans Finance announced a rights issue during the trading session with the intention of raising LKR 185mn to fulfill the capital adequacy requirements that have arisen as a result of the business expansions. Accordingly, the company is offering 7.4mn shares (proportion of 01 for 05) at LKR 25.00 per share. The share closed at LKR 41.90, down by 2.6%.

Foreign investors were net sellers for the seventh consecutive session with a net outflow of LKR 141mn. The foreign participation was at 36%. Top net outflows were reported in Commercial Bank (LKR 151mn) and Sampath Bank (LKR 2mn) while top net inflow was recorded in John Keells Holdings (LKR 9mn).

Lanka Securities Research

Video Story