December, 30, 2015

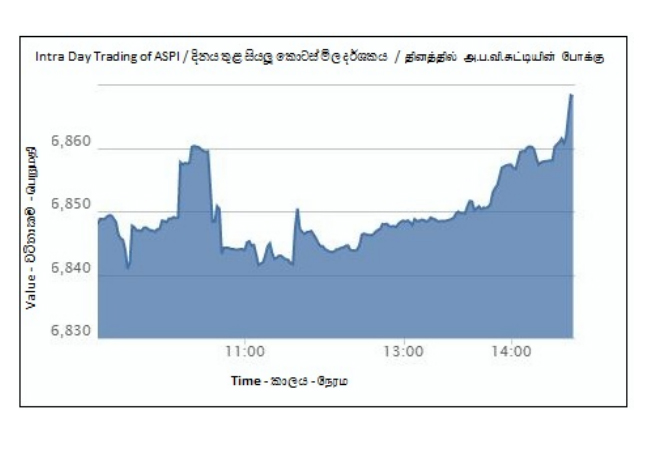

Colombo stock market concluded another dull session on Wednesday ahead of the last monetary policy review of the year. Main index bagged 22.89 index points (+0.33%) to end at 6,870.63 while S&P SL20 index gained 7.42 index points or 0.21% to close at 3,605.07 despite the increase in treasury yield for the fourth consecutive week.

Price increases in high caps namely Commercial Leasing & Finance (end at LKR 4.20, +5.0%), Lanka Orix Leasing & Company (end at LKR 94.00, +3.3%) and Aitken Spence (end at LKR 92.00, +2.8%) pinned the index performance to the greener territory.

Heading towards the year end, investor sentiments remained lackluster and the daily market turnover was mere LKR 271mn. Commercial Bank topped the turnover list with LKR 85mn while Sanasa Development Bank was the second best contributor to the turnover with LKR 21mn supported by a single crossing of 0.13mn shares at LKR 154.00. John Keells Holdings (LKR 19mn), Aitken Spence (LKR 15mn) and Nestle Lanka (LKR 13mn) were among top contributors to the turnover.

Market breadth was mixed where out of 240 counters, 96 advanced, 76 slipped while 68 remained unchanged. Cash map inclined sharply from 34% to 73%. 19 counters declined to 52wk low price while 3 counters managed to reach 52wk high price levels.

High investor activity were witnessed in illiquid stocks namely, Ceylon Printers (LKR 1,737.20, +25.0%), Paragon Ceylon (LKR 994.00, +25.0%) and Office Equipment (LKR 2,390.00, -4.4%) following the companies’ decision to increase the number of shares via sub-division. Further, Access Engineering, Commercial Bank and Haycarb were among heavily traded counters.

Foreign investors closed the session on selling side with a net foreign outflow of LKR 31mn. Foreign participation was 43%. Net foreign outflows were seen in Aitken Spence (LKR 14mn), Access Engineering (LKR 12mn), Commercial Bank (LKR 11mn) while net foreign inflow was mainly seen in John Keells Holdings (LKR 10mn).

Meanwhile, at today’s Treasury bill auction, 3 months yield advanced by 7bps to 6.45% while 6 months yield increased by 14bps to 6.83%. One year treasury bill rate inclined from 7.11% to 7.30% (+19bps). CBSL offered LKR 22bn worth of Treasury bills today and the auction was oversubscribed by 2.0 times with bids received amounting to LKR 43.1bn. It was decided to accept LKR 7.4bn worth of bills.

Video Story