July, 12, 2017

Reuters - Sri Lankan stocks edged down on Tuesday from its 18-month closing high hit in the previous session as investors booked profits in blue chips, while concerns over a proposed tax bill weighed on overall sentiment.

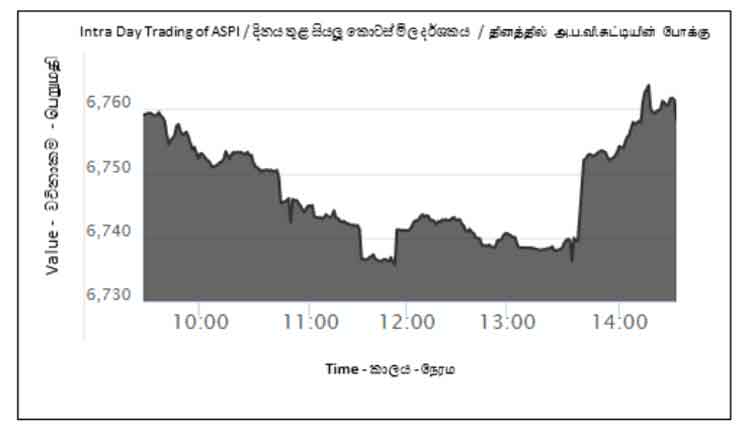

The Colombo stock index ended 0.15 percent weaker at 6,748.15, slipping from its highest close since Jan 7, 2016 hit on Monday.

"The index is down on profit-taking, but the good thing is that retail participation has increased," said Dimantha Mathew, head of research, First Capital Holdings PLC.

"There was less foreign participation today."

Foreign investors net bought 42.3 million rupees ($275,391) worth of shares on Tuesday, extending their year-to-date net inflows to 22.9 billion rupees worth of equities.

Analysts said new foreign investors have been buying Sri Lankan shares since the Pakistani bourse was upgraded to emerging market status from frontier market.

The day's turnover was 559.7 million rupees, less than this year's daily average of 912.7 million rupees.

In May, index provider MSCI announced changes to its indexes as a result of its semi-annual market reclassification, including reclassifying Pakistan as an emerging market from frontier market, and the addition of 57 securities and removal of 28 securities from its All-Country World Index .

Brokers said local investors have been waiting for some clarity on a proposed inland revenue legislation, which a few companies expect will result in higher costs of production.

The IMF, which has long urged Sri Lanka to boost tax revenue through modernisation and simplification of its fiscal system, has urged the government to submit to parliament a new Inland Revenue Act.

Shares of Ceylon Tea Services Plc dived 13.4 percent, Melstacorp Ltd ended 1.8 percent weaker, while conglomerate John Keells Holdings Plc closed 0.2 percent lower.

Video Story