May, 11, 2020

Sri Lanka’s stock market opened today (11 May) after a seven-week trading halt only to shutter within minutes following a more than 10% drop in a gauge of blue chip shares, highlighting the risks of a long hiatus.

According to the stock market trading system, the last transaction has been processed around 11.00.38 a.m.

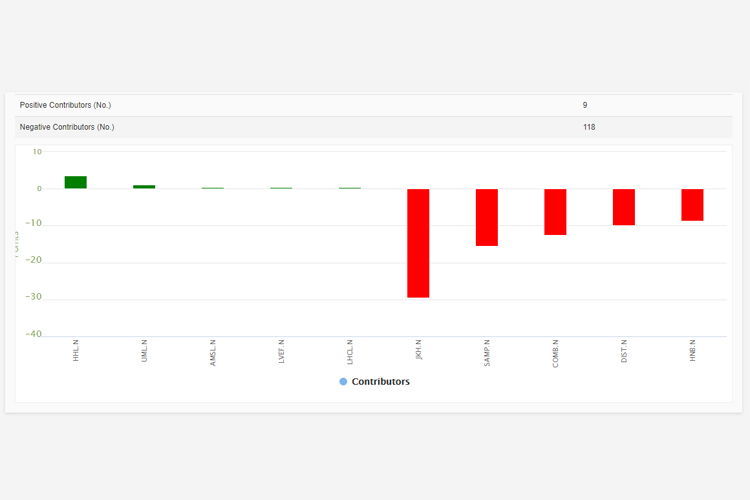

The All Share Price Index (ASPI) closed 179.20 points down at 4,392.43 and the S&P SL20 index indicated a fall of 196.93 points to 1,750.49. This is a decline of 3.92% and 10.11% from the previous close (20 March 2020).

The stock exchange had already shortened operations to two hours as the island nation’s capital remains under curfew even as the government allowed public and private companies to resume operations from Monday.

John Keells Holdings fell Rs.10.40 (9.01%) to Rs.105 a share, contributing most to ASPI’s fall.

Sampath Bank, fell Rs.19.00 (15.97%) to Rs.100 a share, Commercial Bank fell Rs. 5.10 (8.49%) to Rs. 55.00 a share while Distilleries Company PLC closed Rs.1.00 (7.69%) to Rs.12.00 a share, also contributing greatly to the ASPI downturn.

Trading was thin at only Rs. 24 million, with 4.1 million shares traded.

The Securities and Exchange Commission of Sri Lanka (SEC) last week directed the Colombo Stock Exchange (CSE) to implement a Three-Tiered Circuit Breaker structure attached to the SLS&P Index when the market re-opened.

According to the directive, Market Halt has to be imposed for 30 minutes in the event the S&P SL20 index drops by 5%, and another 30 minutes if the Index drops by another 2.5%. If the Index drops by 10% trading will be halted and the market shall be closed for the day.

Meanwhile, Joining ‘Talk with Chatura’ on Ada Derana 24 channel, A business leader and investor Dhammika Perera stated that the stock market should be remain closed until a proper policy is formulated for the next six months.

Meanwhile, Sri Lanka’s monetary authority on May 6 cut benchmark interest rates for a third time since the coronavirus outbreak to bolster the economy against the fallout of the pandemic.