January, 6, 2016

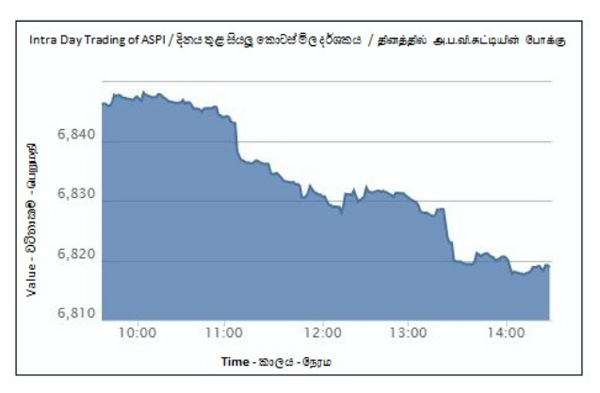

The negative trend of the New Year continued on Wednesday as the benchmark index closed at 6,817.65, a decline of 27.65 index points or -0.40%, while the S&P SL20 index shed -13.07 index points or -0.36% to end at 3,573.18.

Top negative contributors that drove the index lower were Ceylon Tobacco (LKR 970.00, -1.0%), Lion Brewery (LKR 610.00, -3.2%) and Commercial Leasing & Finance (LKR 4.00, -4.8%). However, price increase in the high cap stock Sri Lanka Telecom (LKR 46.00, +1.6%) provided resistance to the drop with positive gains.

Turnover grew from the previous session to LKR 1,396mn, making it the highest turnover in almost a month. Despite high figures, individual investor participation was on the low side as the day’s turnover was mostly dominated by institutional activity. The aggregate value of crossings accounted for 80% of today’s total turnover.

34.4mn shares of Tal Lanka Hotels (Taj) changed hands within Indian Hotels Co Ltd (IHCL) group at LKR 25.00 at the start of today’s trading session. The transaction represented 61.5% of today’s turnover. IHOCO BV acquired 24.6% of the issued capital of Taj from IHCL where IHOCO BV is an indirect wholly owned subsidiary of IHCL. Further 2 crossings of 0.83mn shares were recorded in Commercial Bank at LKR 139.50 and 3 crossings of 14mn shares in Dialog Axiata at LKR 10.50.

As a result top contributors to turnover today came from Tal Lanka (LKR 860mn), Commercial Bank (LKR 180mn), Dialog Axiata (LKR 159mn).

Weak investor sentiments prevailing in the market were displayed as out of the 258 stocks traded only 72 managed to close in the positive territory while 136 registered declines. 50 counters remained unchanged. 28 counters touched 52 week low prices, but only 3 managed to reach a 52wk high price. Cash map decreased from to 44% to 35%.

The CSE approved in-principle an application for listing of Orient Finance on the Diri Savi Board. The initial public offering is for the subscription of 71.5mn Ordinary Voting shares at LKR 15.00 per share. The date of opening of the subscription list is 25th January 2016.

Waskaduwa Beach Resort managed to raise a total sum of LKR 461.5mn through a rights issue offered in the proportion 1 for every 2 ordinary shares. 46.1mn shares were allocated at a consideration of LKR 10.00 per share. Almost entirety of the issue was subscribed by Citrus Leisure which is the parent company of Waskaduwa Beach Resort. With the funds raised through the rights issue, the interest cost of Waskaduwa Beach Resort will decrease and its cash flow position will improve as disclosed in the circular issued to the shareholders regarding the rights issue.

There was considerable interest on the textile & footwear segment as Orient Garments and Textures Jersey were the most traded counters in the market. Furthermore heavy investor activity was witnessed in the counters such as Access Engineering & John Keels Holdings.

Foreign investors were net sellers for the third consecutive day with a net foreign outflow of LKR 132mn. Foreign participation was 83%. Net foreign outflows were seen in Dialog Axiata (LKR 158mn), Seylan Bank (LKR 28mn) & Hatton National Bank (LKR 5mn) while net foreign inflow was mainly seen in Commercial Bank (LKR 48mn).

Meanwhile, at today’s Treasury bill auction, 3 months yield advanced by 14bps to 6.59% while 6 months yield increased by 10bps to 6.93%. One year Treasury bill rate inclined from 7.30% to 7.42% (+12bps). CBSL offered LKR 18bn worth of Treasury bills today and the auction was oversubscribed by 2.1 times with bids received amounting to LKR 37.2bn. It was decided to accept LKR 7bn worth of bills.

Video Story