January, 8, 2016

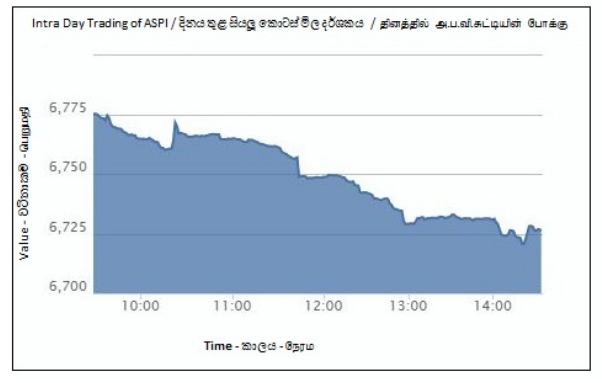

The disappointing trend continued on the fifth session of the New Year as both indices closed with negative returns. All share index shed -48.99 index points (-0.7%) to close at 6,726.28 while the S&P SL20 index lost -32.04 index points (-0.9%) to close at 3,514.41.

Sri Lanka Telecom (closed at LKR 45.70, +1.8%) stood out as it influenced the index positively, when majority of the counters today posted negative gains. Distilleries (closed at LKR 230.10, -4.16%), Carson Cumberbatch (closed at LKR 340.00, -2.86%) & Hemas Holdings (closed at LKR 87.90, -2.66%) were the main drivers to drag the index to the red zone.

Daily market turnover only reached LKR 488mn, despite 4 crossings which accounted for 33% of the total turnover. Textured Jersey emerged as the top contributor to turnover with LKR 63mn underpinned by a single off-the-floor dealing of 1.0mn shares at LKR 33.80. Distilleries (LKR 59mn), Dialog Axiata (LKR 58mn) and Hatton National Bank non-voting (LKR 38mn) were among top contributors to the turnover.

Several crossings were recorded in Dialog Axiata (5.0mn shares at LKR 10.40), Distilleries (0.2mn shares at LKR 235.00) and Hemas Holdings (0.3mn shares at LKR 88.50).

Market breadth was negatively skewed where out of the 232 counters that traded, 148 counters dropped in price, 38 increased and 46 remained unchanged. Being unable to bounce back, the cash map further dropped from 35% to 34%. 46 scripts reached 52wk low prices while none of the counters managed to touch a 52wk high price.

Investors continued to book profits in Textures Jersey (closed at LKR 33.80, -2.59%) and it was the most traded counter in today’s session. Further, high investor activities were seen in Access Engineering (closed at LKR 22.70, -0.87%) & Sanasa Development Bank (closed at LKR 155.50, -0.96%).

Bourse witnessed net foreign inflow for the first time in the New Year as the foreign investors snapped the four-day selling streak to conclude the session on buying side with an inflow of LKR 17mn. Foreign participation was 30%. Net foreign inflows were seen in Hatton National Bank non-voting (LKR 38mn), Textured Jersey (LKR 34mn), Overseas Realty (LKR 16mn) while net foreign outflow was mainly seen in Dialog Axiata (LKR 52mn).

During the opening week of the year, benchmark index dipped 2.4% or 168.22 index points while S&P SL20 index shed 111.28 index points or 3.1%. CIC Holdings (+7%), CIC Holdings non-voting (+3%) and Millennium Housing Developers (+2%) were among the top gainers of the week while Amana Bank (-16%), Aitken Spence (-8%) and Sierra Cables (-8%) were among the top losers.

The average weekly turnover advanced by 171% to LKR 851mn. Tal Lanka (Taj) topped the weekly turnover list with LKR 860mn followed by Singer Industries (LKR 669mn) and Commercial Bank (LKR 583mn).

The foreign investors were net sellers during the week recording a net foreign outflow of LKR 1.5bn. Foreign activity was at 54%. Top net outflows reported in Singer Industries (LKR 575mn), Dialog Axiata (LKR 495mn) and Commercial Bank (LKR 259mn) while top net inflows were mainly seen in Hatton National Bank non-voting (LKR 48mn) and Textured Jersey (LKR 30mn).

Lanka Securities Research

Video Story