December, 11, 2015

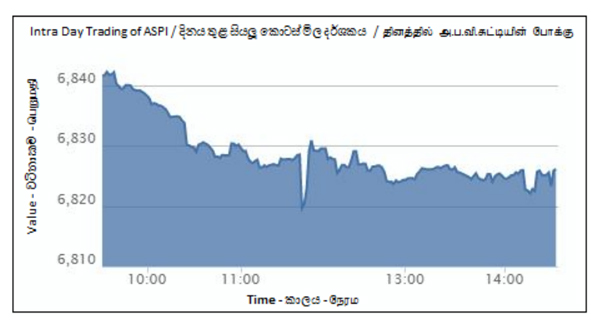

ASI edged lower for the fifth consecutive session on Thursday amid lack of fresh corporate news to spur buying and ASI closed 15.68 points or 0.2% lower at 6,825.87. The S&P SL 20 indexed edged slightly higher marking a mixed session to close at 3,617.45 with a gain of 1.44 points or 0.04%.

However, foreign activity led the market turnover to a 16-month high of LKR 8.1bn where TPG Growth III fund acquired a 28% stake in Asiri Hospital Holdings from Actis Investments via a crossing of 317.1mn shares at a price of LKR 24.00. This transaction contributed 94% of the turnover. Shares of Asiri Hosipital Holdings closed at LKR 24.80,-1.2%.

Further three crossings were seen in Access Engineering (6.8mn shares at LKR 21.80-22.00) and Commercial Bank (0.18mn shares at LKR 140.50).

Excluding the above crossings, market turnover remained low at LKR 294mn. Apart from Asiri Hospital Holdings (LKR 7.6bn), notable contributions were made by Access Engineering (LKR 162mn), John Keells Holdings (LKR 64mn) and Commercial Bank (LKR 49mn). These three counters attracted relatively high investor interest along with shares of Sinhaputra Finance and Ceylon Grain Elevators.

The price declines in premier blue-chips Nestle (LKR 2,080.00,-3.4%), John Keells Holdings (LKR 177.90,-0.6%) and Hemas Holdings (LKR 87.40,-0.2%) drove the index to the negative territory. Market breadth was negative with losers outweighing gainers, 107 to 66 while 57 counters remained unchanged. 34 counters touched 52 week low prices today but the cash map slightly edged up from 49% to 50%.

Driven by the activities in Asiri Hospital Holdings, the foreign participation shot up to 97%. However, foreign investors were net sellers of LKR 113mn worth of shares. Top net outflows were reported in Access Engineering (LKR 107mn), Sampath Bank (LKR 13mn) and Commercial Bank (LKR 8mn) while top net inflow was seen in DFCC Bank (LKR 16mn).

Lanka Securities Research

Video Story