January, 11, 2016

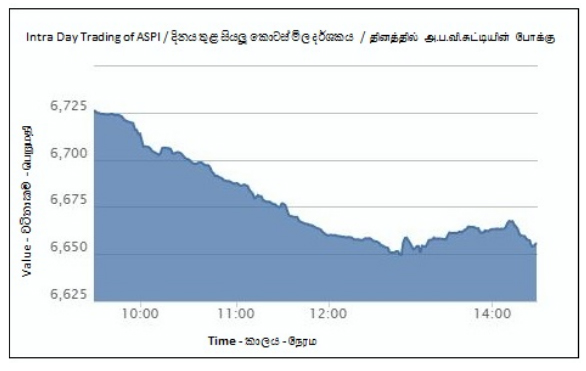

The bleak start to the year continued on the Colombo Bourse as ASI plunged for the sixth consecutive day with market conditions providing little or no incentives to the investors take positions in the battered stocks. ASI nose-dived to a 18 month low of 6,650.32 (down by 75.96 index points or 1.13%) while 20-scrip S&P SL lost over 1.43% or 50.37 index points to conclude at 3,464.04. The recent wave of selling which started last Monday, has knocked down 244.18 points or 3.5% so far, marking the worst six-day percentage loss to start a year since 2008.

Bearish investor sentiment in premier blue-chip John Keells Holdings continued to slash the index performance as the counter declined by 1.6% to LKR 169.50. The stock managed to secure the highest turnover position with LKR 326mn underpinned by several off-the-dealings of 1.6mn shares which changed hands at LKR 169.00-170.00.

Price depreciation in other high caps namely, Cargills Ceylon (closed at LKR 171.80, -6.1%), Hemas Holdings (closed at LKR 85.00, -3.3%) and Lanka Orix Leasing (closed at LKR 88.00, -2.2%) pinned the index performance to the red zone.

Banks & Finance scripts faced high selling pressure and most of the counters touched 52wk low price levels. Accordingly, Commercial Bank (LKR 137.50), National Development Bank (LKR 187.00), Sampath Bank (LKR 234.60), People’s Leasing & Finance (LKR 20.50), Union Bank (LKR 19.30) and Seylan Bank (LKR 88.50) dropped to one year low prices.

Daily market turnover was LKR 991mn which settled above the average YTD turnover, supported by hefty crossings. Bulk transactions captured 47% of the total turnover and were seen in JKH, Commercial Bank (1.22mn shares at LKR 139.00) and Hemas Holdings (0.2mn shares at LKR 88.00). Commercial Bank (LKR 200mn) was second best contributor to the turnover. Further, Hatton National Bank non-voting (LKR 72mn), CIC Holdings (LKR 37mn) and Overseas Realty (LKR 34mn) were among top contributors to the turnover.

As market experienced the worst performance in the new year, 72 counters touched 52wk low prices while only Harischandra Mills managed to reach 52wk high of LKR 2,620.00, following the announcement on capitalization of reserves. Losers outweighed the gainers 174 to 30, while 42 stocks remained unchanged. Despite the decline, cash map improved from 34% to 44%.

Foreign investors closed the session on selling side with a net foreign outflow of LKR 139mn. Foreign participation was 31%. Net foreign outflows were seen in John Keells Holdings (LKR 157mn), Commercial Bank (LKR 99mn), Tokyo Cement non-voting (LKR 11mn) while net foreign inflow was mainly seen in Hatton National Bank non-voting (LKR 71mn). Subsequent to today’s net foreign outflow, year-to-date net foreign outflow increased to LKR 1.7bn.

Lanka Securities Research

Video Story