January, 12, 2016

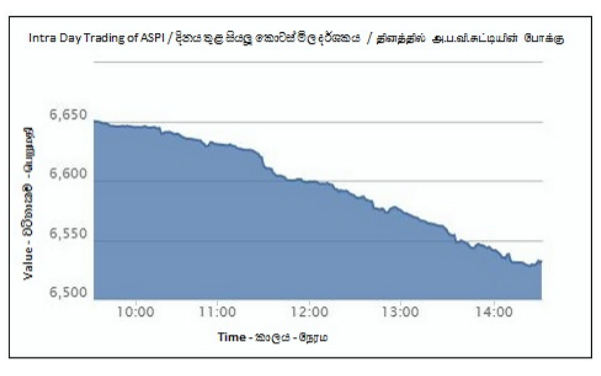

Colombo bourse fell out of the frying pan into the fire today as ASI crashed to a 18 month low of 6,534.35 (down by -115.97 index points or -1.74%), while the S&P SL20 lost -71.00 index points or -2.05% to close at 3,393.04. Today’s decline marked the biggest intra-day drop after 24th August 2015. The downtrend continuing from the New Year has now stripped 360.15 points off the index.

Negative investor sentiments were scattered throughout the market, except in plantations as it remained the only sector to record gains. The lack of significant positive contributors to the index allowed Lion Breweries (closed at LKR 551.00, -9.7%), John Keels Holdings (closed at LKR 166.60,-1.7%) and Hemas Holdings (closed at LKR 80.00, -6.1%) to drive the market to negative zone.

Turnover was a healthy LKR 998mn, displaying an increasing trend in market participation. Institutional investors contributed to 24% of the total market turnover. Accordingly, off the floor dealings were recorded in Commercial Bank (0.95mn shares at LKR 138.00), Cargills (0.42mn shares at LKR 171.80) & Hatton National Bank (0.18mn shares at LKR 201.00). Topping the turnover list was Commercial Bank (LKR 154mn), followed by Cargills (LKR 94mn), John Keels Holdings (LKR 80mn) & Ceylon Tobacco (LKR 60mn).

Majority of the counters witnessed price depreciations as 177 counters dropped, 37 counters increased in price while 36 remained unchanged. Premier blue-chips too seemed to struggle as sellers dominated the market, forcing 8 out of the 20 stocks to touch 52wk low prices. Cash map declined from 44% to 29%.

High cap banks caused the index to decline where Commercial Bank, Sampath Bank, National Development Bank, DFCC Bank, Nations Trust Bank and Seylan Bank reached 52wk low prices by the end of today’s trading session.

Investors showed high interest in the debutant Peoples Insurance (closed at LKR 14.90,-0.7%) as it rose to the top of the most traded stocks for the day. Further, high institutional activity was witnessed in Textures Jersey (closed at LKR 32.30), John Keels Holdings & Access Engineering.

Foreign investors closed the session on the selling side with a net foreign outflow of LKR 271mn. Foreign participation was 33%. Net foreign outflows were seen in Commercial Bank (LKR 137mn), Cargills (LKR 79mn) & John Keels Holdings (LKR 70mn), while net foreign inflows were mainly seen in Overseas Realty (LKR 12mn).

Meanwhile at today’s Treasury bill auction, yields continued to increase for the 6th consecutive week. The 3 months treasury yield advanced by 19bps to 6.78%, while 6 months yield increased by 13bps to 7.06%. One year Treasury bill rate inclined from 7.42% to 7.48% (+6bps). CBSL offered LKR 18bn worth of Treasury bills today and the auction was oversubscribed by 2.4 times with bids received amounting to LKR 42.6bn. It was decided to accept LKR 18.2bn worth of bills.

Lanka Securities Research

Video Story