January, 13, 2016

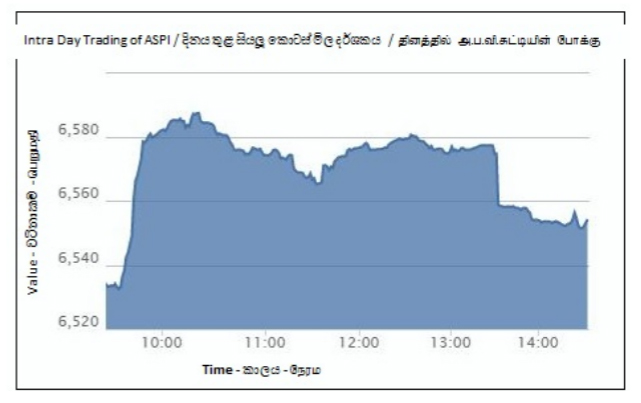

Colombo stock market spun back to the greener zone on Wednesday snapping the seven day losing streak. Benchmark index rebounded strongly to touch 6,587 mark during the opening hours but failed to sustain the momentum and closed with mild increase of 20.02 index points or 0.31% to end at 6,554.37. Reducing losses in blue-chips, 20-scrip S&P SL index closed positive for the first time of the year with an increase of 12.53 index points or 0.37% to close the session at 3,405.57.

Premier blue-chip, John Keells Holdings (closed at LKR 167.90, +1.0%) pushed the index performance higher while high caps such as Commercial Bank (closed at LKR 133.90, -0.8%) & Chevron Lubricants (closed at LKR 313.00, -4.7%) was on opposite side, with recording fresh 52wk low price levels. Along with JKH, two teleco stocks, Dialog Axiata (closed at LKR 10.20, +2.0%) and Sri Lanka Telecom (closed at LKR 44.50, +2.1%) contributed positively to the index performance.

Reflecting moderate institutional activity, few block trades in John Keells Holdings and Commercial Bank uplifted the turnover level to LKR 926mn. In Commercial Bank, 0.7mn shares were changed hands at LKR 134.00 while in John Keells Holdings, 0.8mn shares changed hands at LKR 168.00. Further, single crossing was recorded in Overseas Realty (1.9mn shares at LKR 23.00) and aggregate value of off-the-floor dealings accounted for 29% of the turnover.

Accordingly, Commercial Bank emerged as the top contributor to the turnover with LKR 372mn followed by John Keells Holdings (LKR 170mn), Overseas Realty (LKR 50mn) and Hemas Holdings (LKR 37mn).

High investor activity was witnessed in Textured Jersey, John Keells Holdings warrant 0023 and Access Engineering. Moreover, People’s Insurance captured the center stage today after failing on the debut day of trading. Counter closed at LKR 15.30, with a gain of 2.7%. Despite oil touching 12 year low of USD 30.00 per barrel, Chevron Lubricants continued the slide to a fresh 52wk low price of LKR 313.00. During the year, counter has declined by 9.3% so far.

Positive investor sentiment was seen across the board, where out of 244 counters, 154 advanced, 53 slipped while 37 remained unchanged. Cash map increased from 29% to 34%. 50 scripts declined to 52wk low price levels while only Harischandra Mills increased to a 52wk high price of LKR 3,086.00.

Subsequent to the interim dividend of LKR 29.00 per share in Alliance Finance, stock advanced by 3.4% to end at LKR 850.00.

Foreign investors stood on selling side for the third consecutive day with a net foreign outflow of LKR 312mn. Foreign participation was 34%. Net foreign outflows were seen in Commercial Bank (LKR 339mn), Chevron Lubricants (LKR 25mn), National Development Bank (LKR 12mn) while net foreign inflow was mainly seen in Oversea Realty (LKR 49mn).

Lanka Securities Research

Video Story