January, 19, 2016

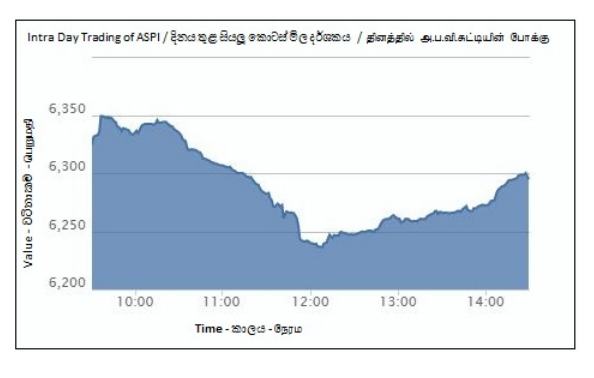

Colombo stock exchange fell sharply at the start of trading on Tuesday, however managed to recover to close at a slightly improved note at 6,283.24, still marking a decline of -41.37 index points or -0.65%. S&P SL20 index followed the same trend, losing -23.06 index points or -0.70% to close at 3,261.30.

Cargills (closed at LKR 158.00, -7.06%) & Bukit Darah (closed at LKR 402.00, -5.41%) were amongst the top negative contributors to the index, where the 2 scripts alone caused the index to drop by -10.82 index points. Lanka Orix Leasing Company (closed at LKR 76.50, 2.00%) was the top positive contributor to the index.

Market turnover was slightly below par at LKR 766mn, with institutional investors accounting for 16.7% of the daily turnover. Distilleries topped the turnover list with LKR 117mn underpinned by a crossing of 0.5mn shares at LKR 215.00 per share. Furthermore, 0.13mn shares of John Keels Holdings changed hands at LKR 158.80 per share. Textures Jersey (LKR 53.7mn) & John Keells Holdings (LKR 48.5mn) were next best contributors to total turnover.

Market breath displayed a more balanced outlook today when compared to the past few days as 80 counters increased in price, 105 counters spiraled down and 54 remained unchanged. Cash map sharply advanced from 17% to 48%. 106 counters touched 52wk low prices, which included blue chip Finance institutes, namely Hatton National Bank, National Development Bank, Commercial Bank, DFCC bank, Sampath Bank, Peoples Leasing & Finance Company & Lanka Orix Leasing Company.

High investor activity was witnessed in Textures Jersey, followed by 2 poultry counters, namely Ceylon Grain Elevators & Three Acre Farms. Along with the price decline in John Keells Holdings (LKR 160.00, -0.4%), warrant 23 touched a 52wk low of LKR 17.00, but managed to close at LKR 18.10, down by 12.1%.

Ordinary voting shares of Ceylon Beverages Holdings have been transferred from the main board to the Diri Savi Board of the CSE, with effect from 19th January 2016, at the request of the company.

Foreign investors were net buyers today with a net foreign inflow of LKR 6mn. Foreign participation was 25%. Net foreign inflows were seen in Hatton National Bank non-voting (LKR23mn), Nestle Lanka (LKR 11mn) & John Keells Holdings (LKR 7mn) while net foreign outflows were mainly seen in Commercial Bank (LKR 27mn).

Lanka Securities Research

Video Story