November, 30, 2015

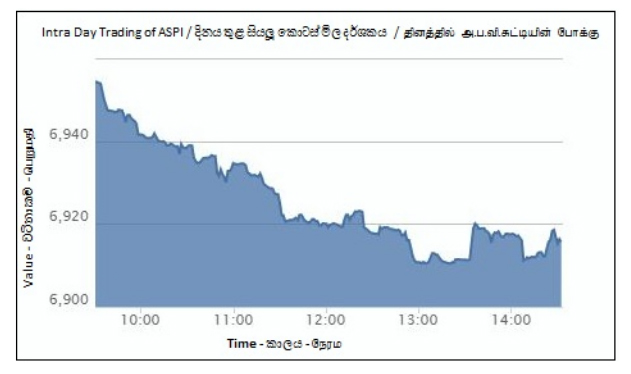

Colombo Benchmark index extended the losing streak for the fourth consecutive day, recording the highest intra-day drop since September and closed at nearly eight month low of 6,909.15, down by 0.75% or 52.26 index points. 20-scrip S&P SL index shed 46.35 index points or 1.25% to close at 3,657.69.

Premier blue-chip, John Keells Holdings (closed at LKR 180.00, -2.5%) dragged the index performance down on its XD date of the interim dividend. Script witnessed heavy trading activity and accounted for 53% of the total turnover. Further, price depreciations in Commercial Bank (closed at LKR 140.00, -3.5%), Nestle Lanka (closed at LKR 2,100.00, -1.7%) and Lanka Orix Leasing (closed at LKR 92.00, -2.8%) contributed to the decline in index.

Daily market turnover was LKR 754mn. John Keells Holdings emerged as the top contributor to the turnover with LKR 403mn underpinned by two off-the-floor dealings of 0.6mn shares at LKR 180.00. Commercial Bank (LKR 55mn), Hatton National Bank (LKR 42mn) and Ceylon Cold Stores (LKR 24mn) were next best contributors to the turnover.

Reflecting the negative investor sentiment, out of 234 counters, 135 slipped, 51 advanced while 48 remained unchanged. Despite the decline, cash map improved from 43% to 59%. 33 counters advanced to 52wk low prices while only Kelani Cables advanced to 52wk high price of LKR 127.50 but closed at LKR 126.70, +1.8%.

High investor participation witnessed in Acme Printing & Packaging, Commercial Bank and Textured Jersey. Among banks, Commercial Bank (LKR 140.00), DFCC Bank (LKR 160.50), National Development Bank (LKR 193.50) and Amana Bank (LKR 4.70) declined to 52wk lows.

Following the listing of right shares of Janashakthi Insurance, counter stepped to a 52wk low of LKR 17.70(-2.2%). Company raised approx. LKR 3.4bn via rights issue to finance the acquisition of AIA General Insurance.

Meanwhile, Lanka Hospitals declared an interim dividend of LKR 1.00 per share. However, stock closed lower at LKR 59.90, -0.3%. Further, Ceylon Printers announced that the right issue of the company has been oversubscribed.

Foreign investors closed the session on buying side with a net foreign inflow of LKR 34mn. Foreign participation was 59%. Net foreign inflows were mainly seen in John Keells Holdings (LKR 80mn), Bairaha Farms (LKR 9mn), Overseas Realty (LKR 8mn) while net foreign outflow was mainly seen in Commercial Bank (LKR 54mn).

During the month of November, All share index declined by 132.91 index points or 1.9% while S&P SL20 index dipped by 145.31 index points or 3.8%. Foreign investors were net sellers for the month with a net foreign outflow of LKR 71mn compared to the LKR 534mn outflow in previous month and foreign participation stood at 34%.

Lanka Securities Research

Video Story