August, 8, 2016

LMD - Amidst domestic and international challenges, Sri Lanka’s economy grew by 5.5 percent year-on-year (y-o-y) in the first quarter of this year, in real terms, compared to 4.4 percent in the corresponding period of 2015, according to the Ministry of Finance’s Mid-Year Fiscal Position Report 2016.

The report also reveals that government revenue increased by 19.6 percent y-o-y, between January and April, while projecting that inflation will be maintained at single digits. But overall export income declined by 4.5 percent y-o-y, in the wake of global market volatility, the report points out.

Forex inflows rose on the back of higher overseas workers’ remittances and tourism earnings; and import expenditure on food, petroleum products and transport equipment fell, causing a 2.4 percent y-o-y narrowing of the trade deficit, in the first four months of 2016.

Meanwhile, Prime Minister Ranil Wickremesinghe reportedly informed a recent forum of plans to implement a new incentive structure for identified investment sectors, along with a streamlined tax regime, to boost both local and foreign investment. This is in line with commitments made to the International Monetary Fund (IMF) and World Bank.

Such moves would likely be welcomed by participants of the monthly LMD-Nielsen Business Confidence Index (BCI) survey, together with the widely applauded appointment of the new Governor of the Central Bank – which, thankfully, ended weeks of political wrangling and a near impasse on whether or not a new face should helm the institution, and who it should be.

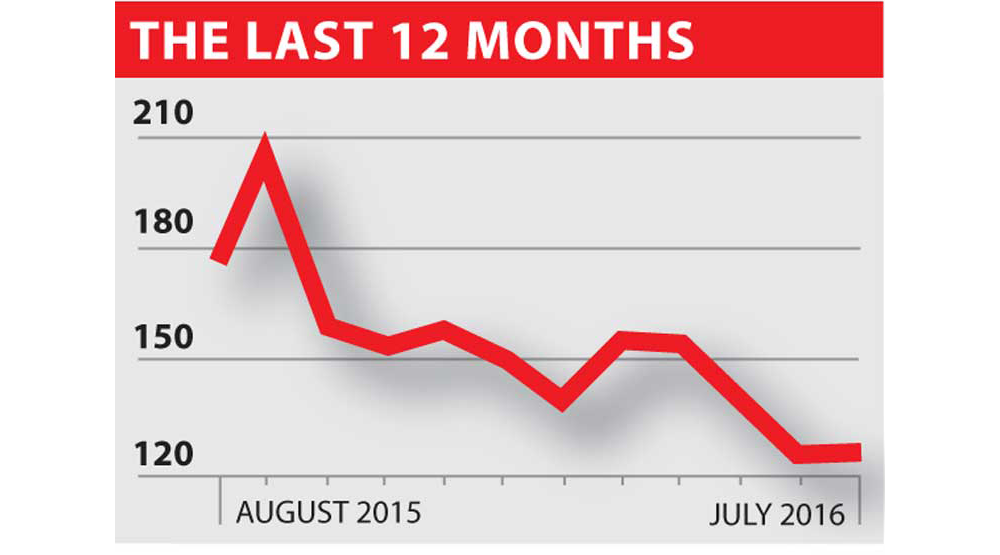

THE INDEX On the back of its 15-point plunge in the previous month, the BCI has remained steady (at 126) in July. That said, the index lies well below its 12-month average (153) and marginally under its all-time average (130). A year ago, the BCI stood at 154, in the run-up to the August 2015 general elections.

At the same time, Nielsen’s Managing Director Shaheen Cader cautions: “Concerns about the economy, political climate and VAT continue to rise, with businesses still uncertain of their short to medium-term business prospects.”

Cader also notes that businesspeople appear to have to “re-evaluate their sales strategies for the remainder of the year, as the recent VAT [rate] increase has greatly reduced consumer demand.”

THE ECONOMY As for the economy, only 29 percent (down from 34%, in June) of respondents feel that conditions will ‘improve’ in the coming 12 months. The ‘majority’ (i.e. 39%) of businesspeople conclude that the economy will ‘stay the same,’ while nearly a third of those polled say conditions will ‘get worse.’

A corporate executive also notes that “the current state of the economy is such that it is affecting the pricing of our products; and our business is taking a hit, because consumer demand has decreased.”

BIZ PROSPECTS Corporates appear to be playing safe, when it comes to business prospects in the next year, with as many as 44 out of the respondents surveyed by Nielsen expecting the status quo to be maintained, while 17 percent have a negative stance and just under four-in-10 predict higher sales volumes. The outlook for the next three months is more or less the same.

While an optimistic member of the business community observes that “business and industry are growing, and we can expect further growth in the future as well,” another laments: “We need to slow down expansion, due to increased costs. There are no incentives given by the Government to businesses, to counter this.”

INVESTMENT The mood seems slightly more upbeat vis-à-vis the investment climate, with at least a quarter (up from 17%, in the prior month) of the survey sample viewing conditions to be ‘good’ or better. Nevertheless, the majority (40%) continue to sit in the naysayers’ camp, while a little over a third only go so far as to label the country’s investment prospects as being ‘fair.’

Speaking to the pollsters, a businessperson remarks that “the investment climate is fair; however, there are many things to be improved, on the Government’s part.” A more optimistic survey participant states: “The investment climate seems to be in a good state, and our markets appear to be more open than in the past.”

SENSITIVITIES As the latest BCI survey suggests, foreign investment is a key factor in the eyes of businesspeople. To this end, a respondent remarks that “the Government does not seem to be focussed on foreign investment; but rather, foreign debt.”

Another biz executive also draws attention to “the imposition of high taxes, as well as the depreciation of the rupee.”

On a more positive note, a member of the corporate community affirms: “Sri Lanka’s image on the international front appears to be improving.”

PROJECTIONS The stabilisation of the BCI comes as somewhat of a surprise, given the rumblings on the regulatory front (e.g. the VAT rate hike, not to mention confusion in the extreme!), ongoing policy miscommunications, a potential Balance of Payments crisis as well as the possible impact of Brexit.

As Cader said on the TV programme Benchmark last month, when asked for his take on the future trajectory of the BCI: “From where we are now, I believe it would be a long haul to see it go back up. It will turn around, but this will take time.”

It is unlikely, therefore, that the index will make any noteworthy gains in the near term, and the corporate and investor communities may well breathe a sigh of relief, if it continues to hover in a range that reflects stability – except, of course, that the present score is lower than the BCI’s all-time average.

That can’t be good news, given that Sri Lanka is no longer grappling with a protracted civil war.

Video Story